After several months of downgrades, the latest Credit Benchmark consensus data show improvement across multiple categories of financial counterparts.

Intermediaries saw more upgrades than downgrades for the first time in several months. Prime Brokers had the highest instance of downgrades last month, with a ratio of 5:1 deterioration-to-improvement; it’s now at a modest 1.3:1. Custodians and Sub-Custodians moved from a ratio of 3:1 deterioration-to-improvement last month to a current net positive ratio of 0.9:1; Broker Dealers changed from 2.5:1 to 0.4:1.

Most categories of banks also showed improvement. The ratio for Latin American Banks showed heavy deterioration at 14:1 last month but is now net positive at 0.4:1. North American Banks and G-SIBs moved from 4:1 last month to 0.3:1 and 0.5:1 in the latest update. EMEA Banks are an exception this month. While the current ratio of 2.5:1 is an improvement from last month’s 3.1:1, this is still the highest rate of deterioration for any of the Financial subsets this month.

According to David Carruthers, Head of Research at Credit Benchmark:

“The dominance of improvement in consensus opinion is a welcome change after several months of deterioration, particular for entities like prime brokers that are so important to the functioning of the financial system. EMEA banks were one of the few exceptions this month. Additional downgrades could cause concern for the banks themselves but also for the broader economy that depends on them for lending. Thankfully, banks are in a relatively strong position overall. Improving economic prospects will only make them stronger.”

The European Commission projects the region’s economy to expand faster than previously anticipated, with growth of 4.8% this year and the volume of output returning to its pre-crisis level by Q4 2021, one quarter earlier than projected in the spring.

As noted by Bloomberg, the ECB is seeking to extend one of its key pandemic-era relief changes, permitting a change in how leverage ratios are calculated, indicating the region’s “stronger reliance on bank loans, rather than capital markets, as a source of corporate financing.”

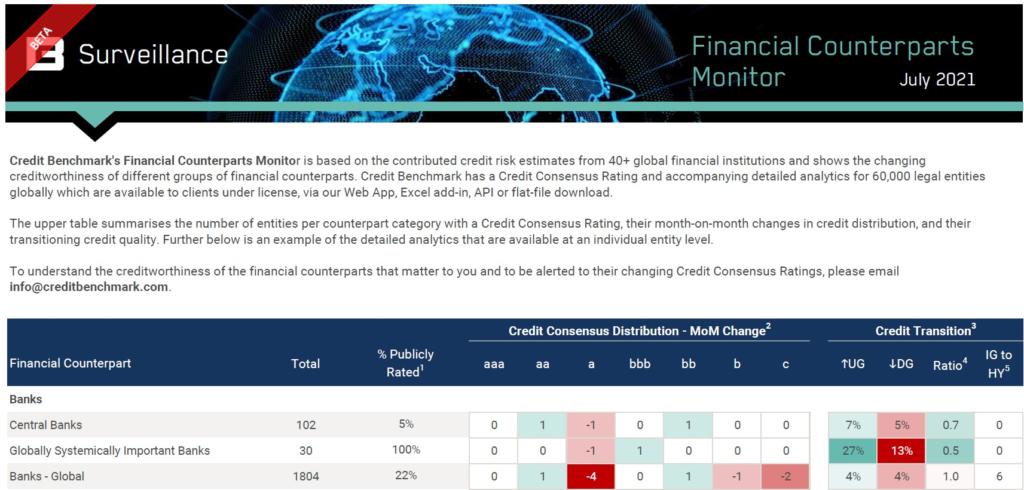

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.