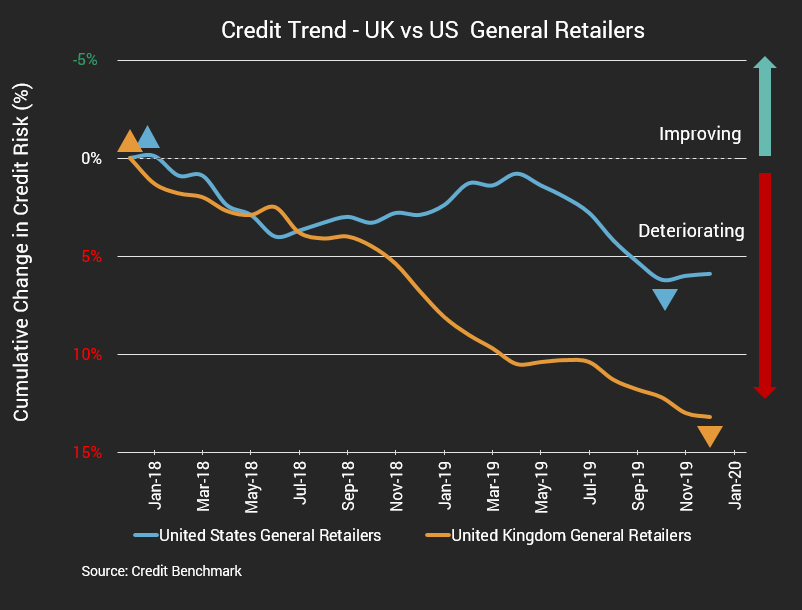

Retailers continue to feel the long-term effects of the ‘retail apocalypse’, and the credit quality trends for UK and US general retailer companies prove lenders remain cautious about the sector.

And whilst the post-election ‘Boris-Bounce’ saw an uptick in UK business activity, retailers appear to have missed out on renewed consumer enthusiasm.

US retailers ended 2019 on a more positive note, with 0.3% growth in December. The growth capped off an underwhelming year however, and the sector still has some way to go in recovering from earlier credit deterioration.

UK general retailers saw their credit quality deteriorate 0.28% on a month-over-month basis to close the month with an average probability of default of 70.9 basis points. On a year-over-year basis, UK retailer corporate credit quality has deteriorated 5.98%, continuing a trend that began in 2016.

US general retailers have seen their credit quality improve by 0.20% on a month-over-month basis, currently maintaining a probability of default of 51.1 basis points. On a year-over-year basis, credit quality for US retailers is down 2.82%.

About Credit Benchmark Consensus Aggregates

Aggregate Analytics are macro-level risk indicators that assess and compare credit trends and distributions across 105 countries, 300 industries and 75 sectors. Hundreds of trend-tracking, forward-looking Aggregates are available, reflecting Credit Benchmark’s expanding universe of 800,000+ contributed credit risk observations from the world’s leading financial institutions.

To download the February 2020 Retail Aggregate PDF, click here.