The automobile industry is particularly vulnerable to supply chain disruptions, and politically-driven trade issues such as the US/China trade wars and Brexit have hurt auto companies in the past year.

The spread of the COVID-19 virus threatens to further undermine production and a lack of preparedness will threaten even the strongest makers and suppliers.

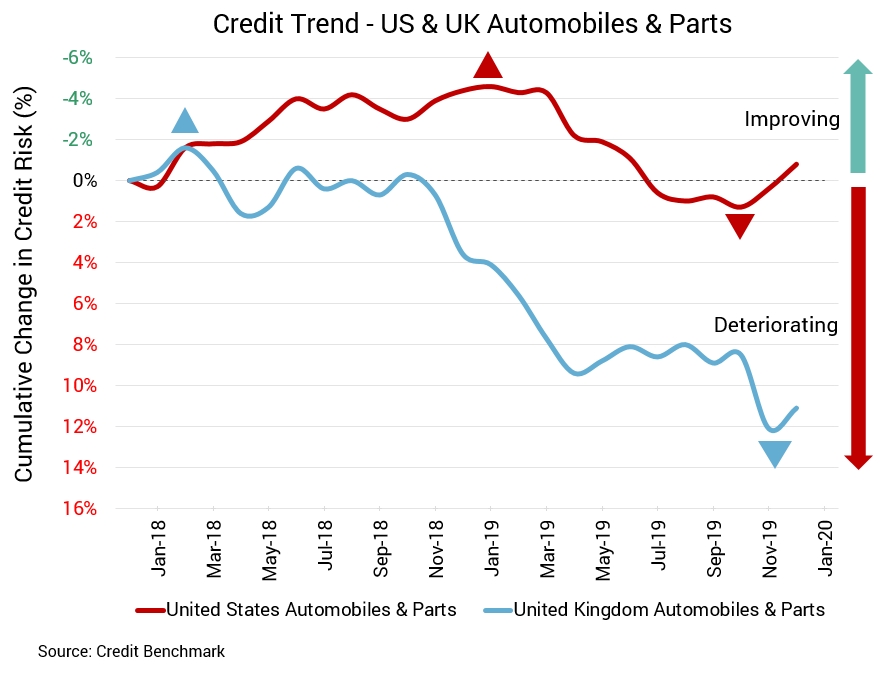

Consensus credit data shows early signs of improvement for both US and UK auto companies after extended deterioration, but as the full impact of the COVID-19 virus unfolds, this improvement may be short lived.

Credit risk for US auto firms has improved 1.1% on a month-over-month basis to close the month with an average probability of default of 36.5 basis points. On a year-over-year basis, corporate credit quality for the US auto industry has deteriorated by 3.7%. The current Credit Benchmark Consensus (CBC) rating for the companies that make up the auto industry aggregate is bbb-.

For UK-based auto manufacturers and parts suppliers, credit quality has improved 0.9% over the past month, following a protracted period of deterioration. The current average probability of default for firms in the UK auto sector is 57 basis points, a deterioration of 7.3% on a year-over-year basis. The current Credit Benchmark Consensus (CBC) rating for the UK auto aggregate is bb+.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

To download the February 2020 Auto Aggregate PDF, click here.