The ranks of the Fallen Angels – firms whose credit quality has made the shift from investment-grade to high yield, or “junk” status – continue to grow, but the pace may be slowing down.

Consensus credit data from Credit Benchmark – which gathers the collective credit quality estimates of lenders to these firms – shows that a growing number of companies have now entered the Fallen Angel category. However, the pace of growth is slowing, with 61 new companies earning the Fallen Angel designation this month, down from 152 last month.

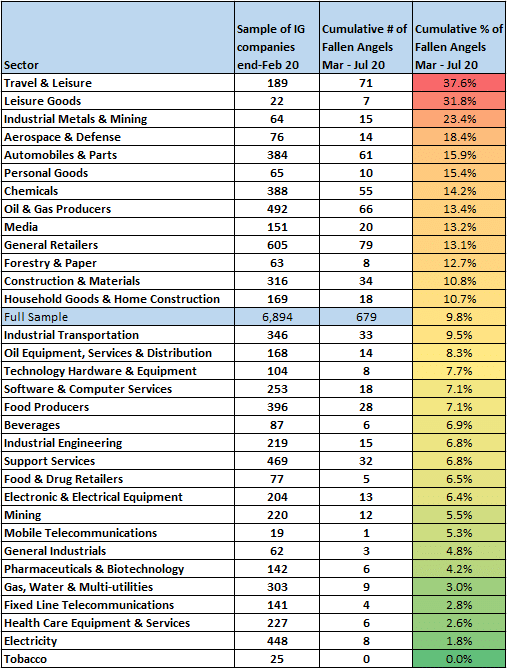

Each month, Credit Benchmark tracks a global sample of corporations across all sectors to gauge the percentage of firms at risk of losing their investment grade status. This month’s report captures Consensus credit data for 6,894 companies in total and finds that 679 (about 10%) are now classified as sub-investment-grade, according to the internal risk views of over 40 leading global financial institutions.

Travel & Leisure, Leisure Goods, and Industrial Metals & Mining sectors continue to have the highest percentages of Fallen Angels, with 38%, 32%, and 23%, respectively.

Aerospace & Defense and Chemicals sectors have continued to see their credit quality deteriorate, now with 18% and 14% of constituents categorized as Fallen Angels, respectively.

Automobiles & Parts, Personal Goods, and Oil & Gas Producers have also shown month-to-month credit quality deterioration with 16%, 15%, and 13% of constituents now classified as Fallen Angels. The same can be said for Household Goods and Home Construction (11%).

Widely cited research has suggested that, even though credit ratings agencies have only downgraded a handful of companies from investment grade to high yield so far this year, up to a third of all corporate bonds in the BBB category could shift to “Junk” status. Credit Benchmark Consensus credit data supports this thesis.

The credit sample examined above is based on issuers as opposed to issues and includes all investment-grade companies, not only BBB. Still, the growing Fallen Angel rates shown here – which cover just five months of the COVID crisis – indicate that the shift for some sectors by the end of 2020 may be yet higher than has so far been suggested.