Author: Thomas Aubrey, Risk Advisor

In October 2021, the European Commission published its proposals to amend Capital Requirements Regulation 575/2013, which includes the requirements related to credit risk and the output floor for banks. Since the Basel guidelines were updated in 2017, market participants have registered a substantive issue with regulators related to the output floor, which will result in a dramatic increase in capital requirements due to the jump in risk weights for unrated corporates. The Basel definition of corporates includes mutual and pension funds.

The aggregate output floor requires a bank’s risk weighted assets (RWA) using an internal ratings-based (IRB) approach to not be lower than 72.5% of RWA as calculated by the Basel standardised framework. The impact of the pending Basel rules is that high quality credits that have no external rating would see a significant jump in risk weight to 100%. The vast majority of corporates do not seek an external rating due to costs. Furthermore, because ratings are typically used by issuers to facilitate access to capital markets and funds generally do not need access to capital, the tens of thousands of high-quality funds have had little use for a rating.

The European Commission has responded to these concerns and has recommended that there should be a transitional arrangement for unrated corporates and funds. IRB institutions would apply a preferential risk weight of 65% to their corporate and fund exposures that do not have an external rating, provided those exposures have a probability of default of less or equal to 0.5% or 50bp, which is consistent with an investment grade rating. This is particularly relevant to funds given that more than 99% of them do not have an external rating and most mutual and pension funds are investment grade.

Despite this transitional proposal to reduce risk weights from 100% to 65%, the new rules will still likely have a dramatic effect on the buyside resulting in declining market liquidity and wider bid offer spreads driving up costs for pension and mutual funds. This is due to the way in which the new rules will impact securities lending activity. This will also create further negative headwinds for a Capital Markets Union across the EU.

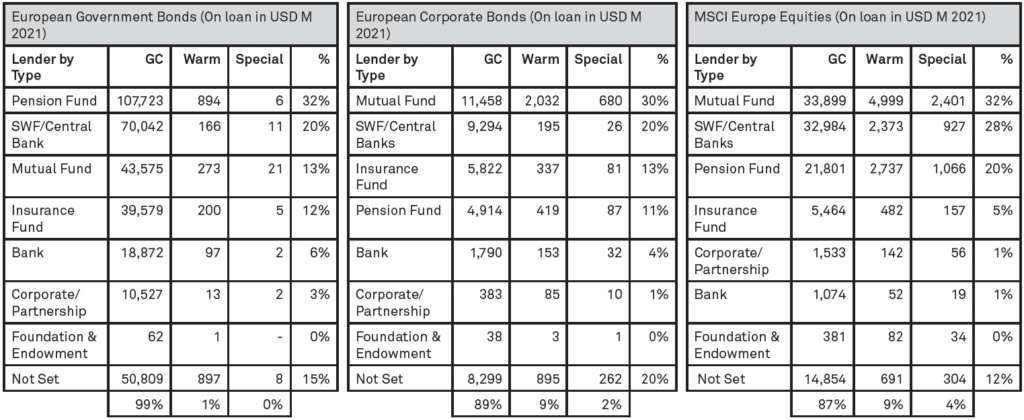

Pension, mutual, insurance and sovereign wealth funds are responsible for lending out 76% of European government bonds, 75% of European corporate bonds, and 85% of European equities.

Figure 1: Lenders of European Securities by Institution Type 2021

Source: S&P Global

Entities that borrow these securities pay the funds an income, which in turn boosts the returns for savers. According to S&P Global data, European institutions in 2021 earned around $1.4bn by lending out securities, or €1.2bn*. These securities are either used for hedging investment positions, liquidity, financing and in some cases to short the company.

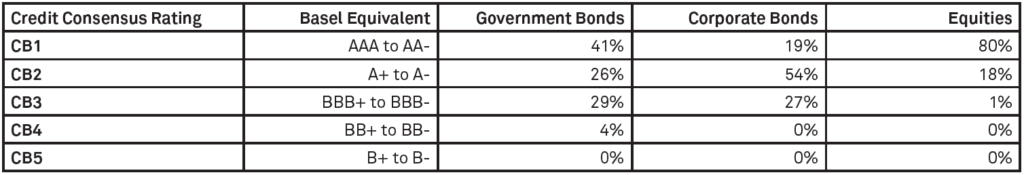

The vast majority of funds lend out their securities to large banks’ prime broker desks, and as part of the Basel rules, these banks need to rate the credit worthiness of their counterparties. An analysis of the credit quality of funds that lend out securities shows they are mostly of the highest credit quality. 67% of funds that lend out government bonds have either a CB1/CB2 Credit Consensus Rating, 73% of funds that lend out corporate bonds have either a CB1/CB2 Credit Consensus Rating, while 98% of funds that lend equities have either a CB1/CB2 Credit Consensus Rating. CB1 is equivalent to AAA to AA- and CB2 is equivalent to A+ to A-.

Figure 2: Credit Quality of Lenders of Securities

Source: Credit Benchmark, S&P Global

Large IRB banks, which dominate securities financing activity across Europe, are particularly impacted by the pending Basel rules. At the moment, these banks are able to estimate the credit risk of these funds based on their internal models that have been signed off by their national regulator. As noted above, more than two thirds of the lending of European corporate and government bonds is by obligors with a rating above A-, whereas nearly all of equities are lent by high quality obligors. Following discussions with a number of IRB banks, we estimate that a typical risk weight for high quality mutual and pension funds is around 12.5% – although there is of course some variation above and below this figure.

Given that 99% of these tens of thousands of funds do not have an external rating but are nearly all investment grade, the risk weights of these counterparties could jump as much as fivefold from an average of 12.5% to 65% based on the Commission’s transitional arrangement. A handful of sovereign wealth funds from OECD countries, that can demonstrably be shown to be backed by its government, may continue to receive low risk weights.

This increase in risk weights will drive up the cost of securities financing significantly. For analytical purposes it is assumed that banks allocate the capital requirements from a binding output floor to that business activity, and then pass on the cost of the capital associated with this additional RWA to their counterparties. Assuming the current cost of RWA capital is around 3bps**, a fivefold increase would mean that it would rise to 15bps for securities financing transactions.

This dramatic increase in the cost of capital will have two major effects on the buyside across Europe.

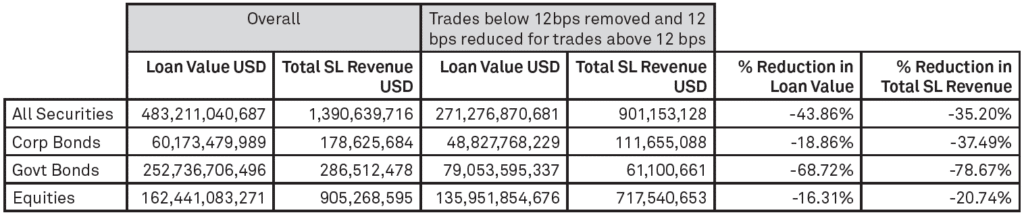

First, European savers will experience a material reduction in the annualised €1.2bn income they currently receive from lending out securities. The increase in cost will mean that lending out securities for general collateral (GC), which are mostly used for hedging and liquidity, would largely cease. GC accounts for the bulk of the securities lending market in terms of loans outstanding. Specials, which are generally used for shorting, would be less impacted as these earn a significantly higher income. As noted above, one approach to estimate the potential loss in income to the European buyside is to assume that the increased 12 bps of costs would be passed through to funds resulting in all transactions taking a 12bps cut. Such an outcome would result in a loss of around 35% of overall income from €1.2bn to below €800m.

Figure 3: Revenue Reduction Flowing to European Funds Due to Rising Costs

Source: S&P Global

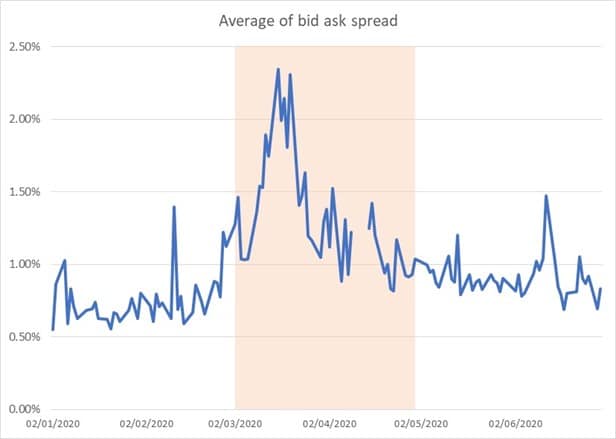

Second, a decline in securities financing activity will dry up market liquidity which in turn will result in wider bid ask spreads and higher transaction costs for funds. According to the Committee on Capital Markets Regulation in the United States, the impact of short selling bans – which can be used a proxy for a decline in securities financing activity – resulted in a significant fall in market liquidity. A study by Beber and Pagano indicates that average bid ask spreads widened from 4.05% to 6.03% based on analysis of over 30 markets including most European markets.

Recent analysis of the Austrian equity market which banned short selling on March 18 2020 shows that when securities financing activity drops, bid ask spreads widen. Average bid ask spreads prior to the ban were 0.9%, which spiked at 2.3% after the ban was imposed.

Figure 4: Austrian Market Average Bid-Ask Spread 2020

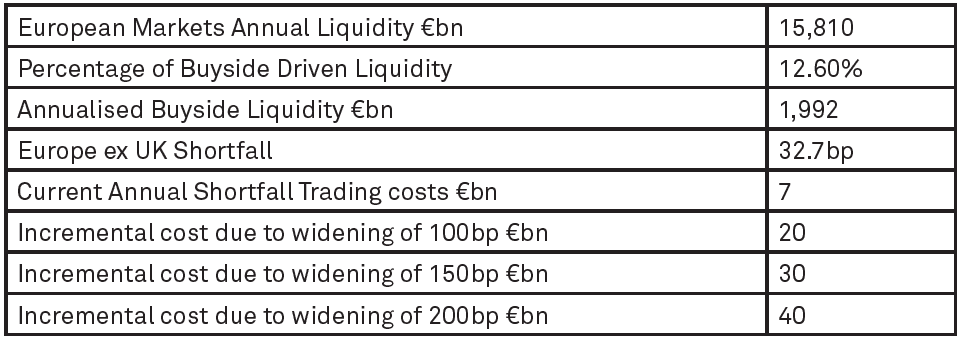

To estimate the increase in trading costs due to widening bid ask spreads, the methodology used by Nasdaq was followed. According to Nasdaq, 12.6% of daily liquidity in the US is attributable to mutual and pension funds. Although we do not have the breakdown across Europe, it is not unreasonable to assume that liquidity driven by pension, mutual and insurance funds is of a similar nature. Using the data provided by the Federation of European Stock Exchanges (FESE) it is possible to estimate a proxy for total annual liquidity of €15.8 trillion, of which around €2 trillion is therefore driven by institutional investors.

SIFMA provides data on trading costs and the component that is related to shortfall, which is the difference between the arrival price and the execution price for a trade. This enables an estimate of the increase in trading costs to be computed due to a widening of bid ask spreads. Figure 5 provides a range of widening bid ask spreads from 100bps up to 200bps resulting in trading costs increasing from €20bn up to €40bn per annum. As costs increase there is likely to be some depressing impact on volume, although it is not clear what the sensitivity of this is likely to be.

Figure 5: Revenue Reduction Flowing to European Funds Due to Rising Costs

Source: Nasdaq, SIFMA, FESE, Credit Benchmark

Finally, it is important to note that if liquidity in government bonds dries up then this might also place greater pressure on widening yields across the eurozone, thereby impacting the ability of governments to fund themselves. This is likely to be of concern for the ECB which is already having to deal with widening Italian government bond yields.

The securities financing industry has shown significant resilience in implementing solutions to mitigate the impact of regulatory changes on transactions. For example, the use of pledge for borrowers to transfer collateral to lenders by way of security interest rather than an absolute transfer of title has been implemented in certain areas of the market. But in order for the industry to come up with appropriate solutions to mitigate the effects of the Basel reforms, there needs to be an urgent recognition by regulators, policy makers and industry participants that the European savings industry is facing a significant negative shock.

*Based on the average 2021 exchange rate of €1 to $1.18.

**The cost of RWA is approximated by EAD x RiskWeight x Cost of Capital x Tier 1 Capital Ratio. The outputs will vary by bank and the results can be sensitive to the initial assumptions. For the analysis we use a 3bps estimate.