US General Retailers may not yet feel like the proverbial child in the toy store, but for the first time in a long time they have some cause for hope. Sales continue to rise, even if the pace is less than anticipated. A lack of in-store shopping has, in some instances, transferred to online shopping. But with COVID remaining an issue and many still struggling economically, a Christmas miracle may be unlikely for the sector. Retail sales are also rising in the UK, yet consumer confidence remains weak, as does the overall economy as COVID cases remain elevated. Further lockdowns are already happening in both the US and the UK which may further inhibit economic growth, putting additional pressure on retail.

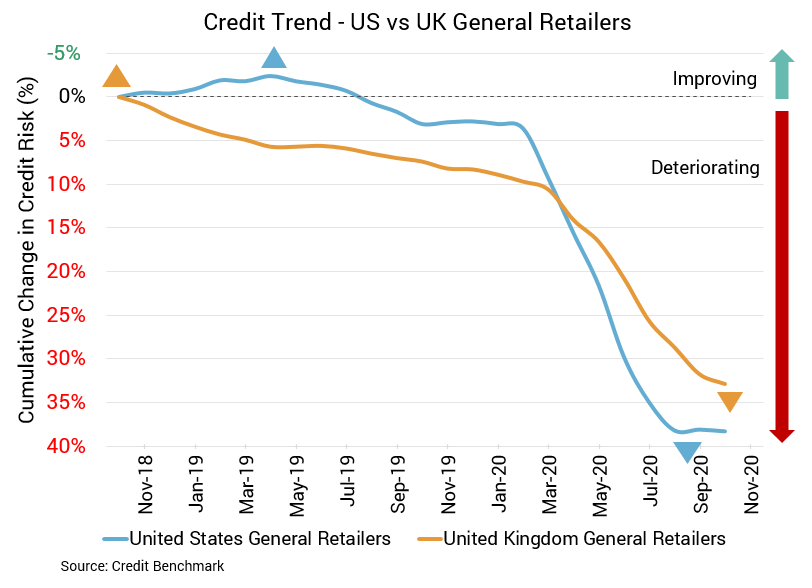

Flatness is the latest trend in the US retail sector. In previous months, credit quality had declined and default risk had increased. Now credit deterioration has levelled off. Credit quality for US general retail firms is unchanged from the prior month. However, it’s still down about 20% from six months prior and about 34% from the same point last year. Default risk continues to be stable at 57 basis points, unchanged from the prior month but higher than it was six months ago at 50 basis points and at the same point last year at 43 basis points. Past deterioration is evident and approximately 77% of firms in this sector have a CBC rating of bbb or lower. This sector’s overall rating is bb+.

The credit situation for the UK retail sector has been dim, but there are signs the negative trend is slowing down. Credit quality for UK general retail firms is down about 1% from the prior update, compared to a decline of about 16% from six months prior and about 24% from the same point last year. Average probability of default remains higher than in the US, at 85 basis points, up from 84 basis points the prior month, 73 basis points six months prior, and 68 basis points at the same point last year. About 92% of firms have a CBC rating of bbb or lower, and this sector’s overall CBC rating is bb.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 50,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 75% of the entities covered are otherwise unrated.