Australia has so far weathered the Covid storm in reasonable shape – though rising case figures driven by the Delta variant have led to numerous snap lockdowns. The country is one of the few Sovereigns rated AAA by the three largest traditional rating agencies, but with a credit consensus rating of aa+, Banks have taken a slightly more cautious view of Australia’s creditworthiness.

This research analyses a number of Australian industries, sectors and companies to demonstrate the Covid effect on national credit quality comparative to global trends. The usual Covid casualties – especially in Travel & Leisure – are apparent, but it is clear that in credit terms, most Australian industries – domestic and international, capital and consumer – are typically outperforming their global peers.

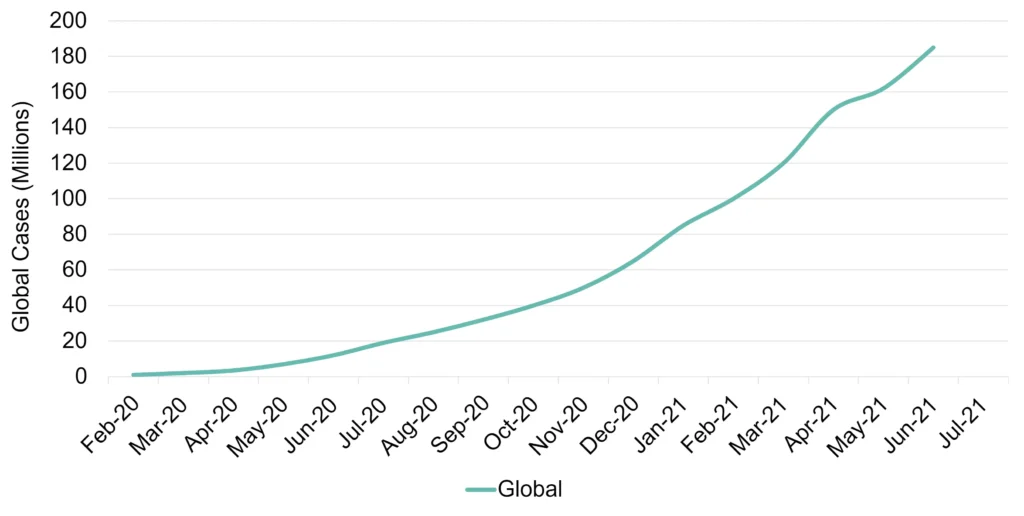

Figure 1 shows cumulative Australian and Global Covid cases since the start of the pandemic.

Figure 1: Covid cases, Australia vs Global

Australian case growth rates began to level off in August 2020; global rates have continued at a consistently faster pace. Tight travel restrictions, strict local lockdowns and a comprehensive vaccination program backed by hard hitting advertising have contributed to a relative success story; although cases are growing again as the more infectious Delta variant spreads.

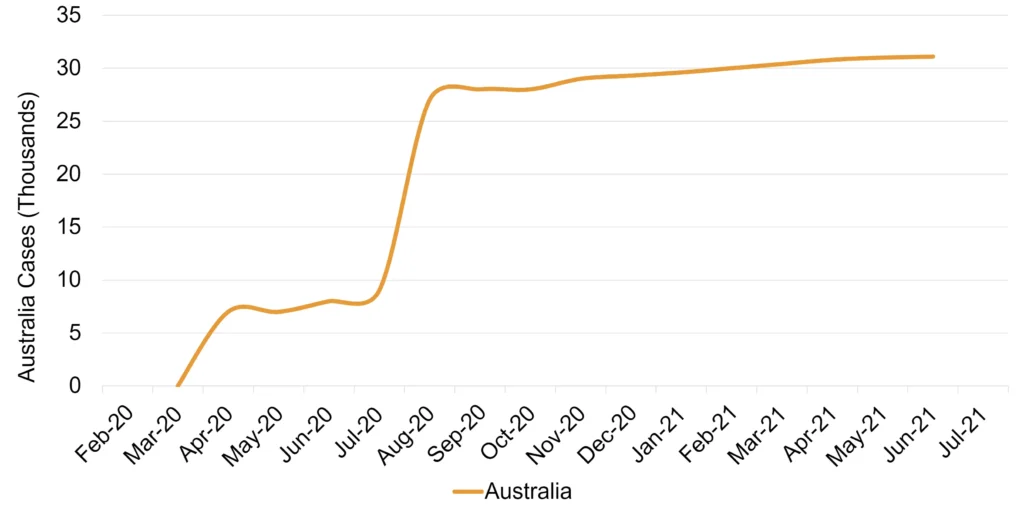

Australian credit risk trends mirror the Covid case graphs. Figure 2 compares the combined Corporate and Financial credit risk picture for Australia vs. the Global trend [please continue below to access full report].

Figure 2: Corporates and Financials: Australia vs Global