Understand your risk

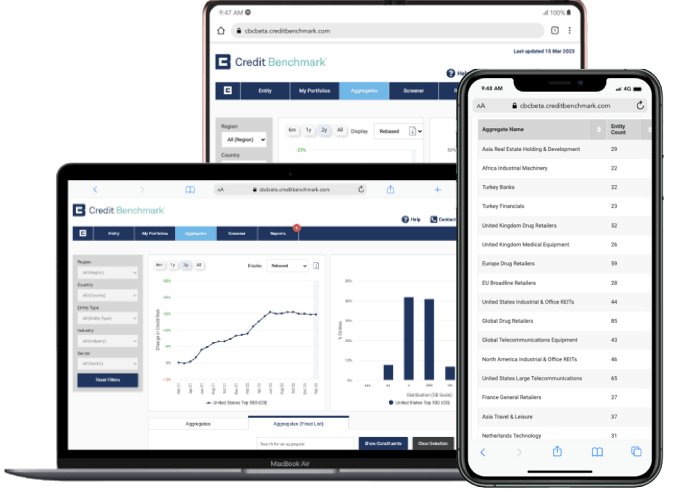

Request a coverage check of your portfolio & access unique insights and analysis from our exclusive, contributed credit risk dataset.

Quickly measure the credit risk of a portfolio across publicly rated and unrated obligors, and pinpoint areas of potential concern for further analysis.

Venture into new geographies with the largest global source of credit risk data, benefiting reinsurance solutions by reaching otherwise opaque markets.

Complement issuer-sourced information, putting an issuing bank’s credit view into the context of those of leading global peers with real-world exposures; identify large outliers and systematic bias.

Fill in the gaps in the portfolio on unrated or unknown names, supporting capital relief trades by making trades more efficient and securing appropriate pricing.

Track divergences between Credit Consensus Ratings and credit rating agencies for a more up-to-date view of risk and leverage in pricing meetings, benefiting credit risk transfer strategies.

Enhance investor understanding of the risk profile of undisclosed portfolios with industry, sectoral or geographical risk indices, providing valuable insights for portfolio risk management.

Entities with Credit Consensus Ratings

Bond and Loan Rating Assessments, Representing $34+ Trillion Outstanding

Risk Observations Feeding Into Twice-Monthly Data Updates

Credit Risk Observations Collected Since Launch in 2015

Industry & Sector Indices

Countries Covered

Major Global Banks Contributing, Almost Half Are GSIBs

Credit Analysts Contributing Risk Views

Of Universe Unrated by Traditional Rating Agencies

Of Corporate Universe Are Private Companies

Unparalleled coverage of public and private issuers; filling the gaps left by traditional ratings agencies.

Free from “issuer-pays” conflict and any bank bias.

Driven by the credit views of >40 of the world’s largest regulated banks, almost half of which are GSIBs.

Risk data is processed through a sophisticated purpose-built mapping engine.

The consensus is refreshed twice monthly to provide dynamic indicators of potential credit risk changes.

Assess risk over the lifetime of a transaction.

Ease of internal integration within reporting.

A unique growing global dataset.