The charts show Credit Benchmark’s credit risk data on Large Consumer Goods companies in the US sourced from 30+ of the world’s leading financial institutions.

After a period of steady deterioration, the credit outlook for US Large Consumer Goods industries has recently improved.

Consumer-driven sectors have been hit by some heavy corporate debt burdens and changes in shopping habits, but Chicago Fed President Charles Evans recently pointed to the continuing strength in the labor market and corresponding robustness in overall consumer demand.

Major financial institutions draw on a broad range of data sources and model factors in estimating industry credit risks, so consensus data from Credit Benchmark provides a more robust view of the credit outlook for companies in consumer-driven sectors, rather than consumer confidence alone.

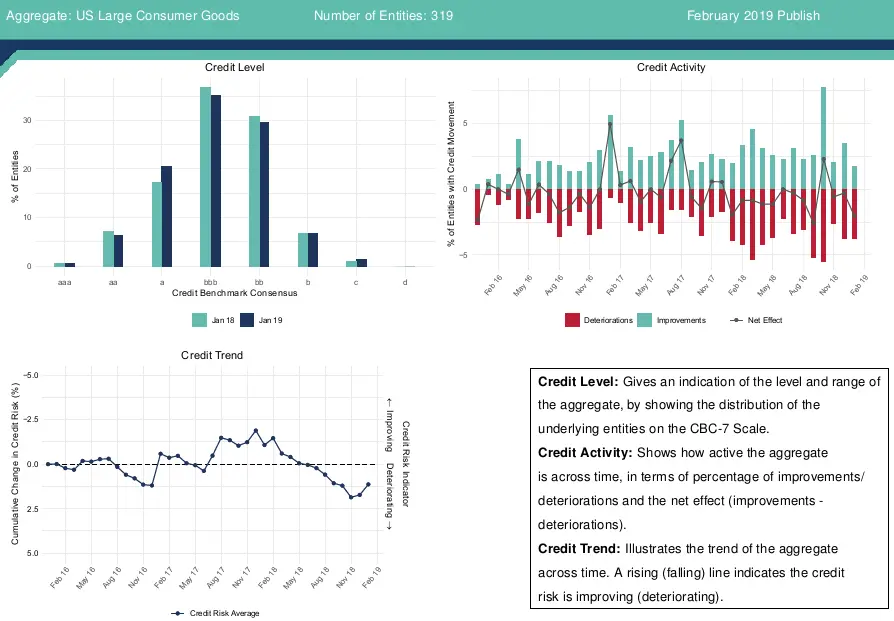

Chart 1 (Credit Level) highlights the Credit Benchmark consensus designation for US Large Consumer Goods year-to-year. Most borrowers are in the a, bbb, and bb categories, with the number of entities rated a increasing modestly by 3% from Jan 18 – Jan 19. In contrast, the number of entities rated bbb or bb decreased slightly over the same time period.

Chart 2 (Credit Activity) shows that downgrades outnumber upgrades in 23 of the previous 38 months. This negative trend was particularly noticeable in the past year, with 10 out of 12 months showing a net downgrade.

Chart 3 (Credit Trend) shows that after a steady ten-month deterioration, the credit risk average of US Large Consumer Goods began to indicate a modest improvement from November 2018. From peak to trough, the swing towards deterioration represents about a 5% increase in credit risk.

The Conference Board Consumer Confidence Index® for February showed an increase (from 121.7 to 131.4) following volatility in recent months around the government shutdown, trade tensions, and interest rate increases, according to the Conference Board. The Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, improved from 170.2 to 173.5. The Expectations Index, based on consumers’ short-term outlook for income, business and labor market conditions, moved from 89.4 to 103.4.