Credit Benchmark, the leader in consensus based credit analytics, today announced the launch of a new monthly measure of credit risk for US and European corporates in the industrials sector. The Credit Benchmark Credit Consensus Indicator (CCI) is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

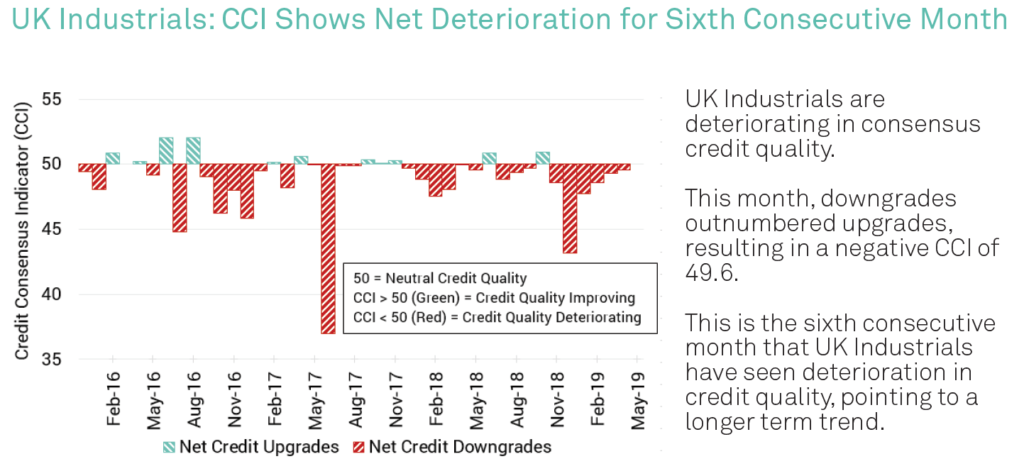

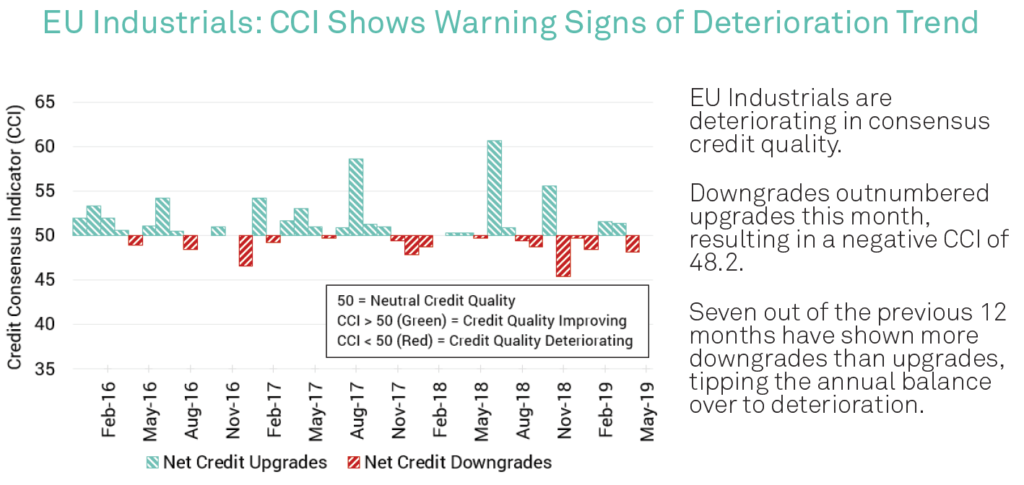

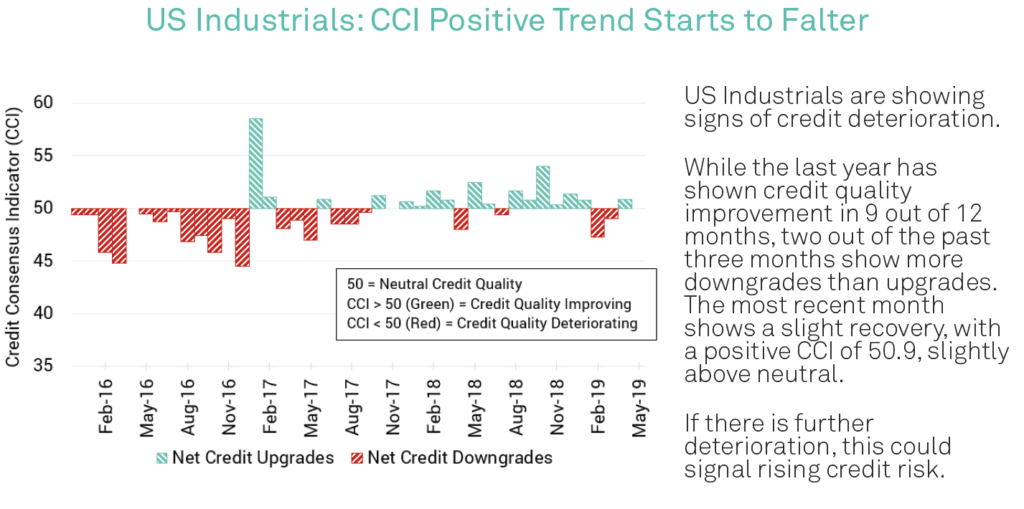

Drawn from more than 750,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The June CCIs show rising credit risk in the UK and EU, but a slight improvement in the US.

The UK CCI for June is 49.6 and has been in deteriorating territory for the past six months.

The EU CCI for June is 49.6, the first dip below 50 in three months.

The US CCI for June is 50.9, after two months of deterioration. Most months in 2018 showed improvements in the US but the picture is now more mixed.

“Recent CCIs indicate pessimism among analysts tracking industrials, especially in the UK, and less optimism in the EU.” said David Carruthers, Credit Benchmark Head of Research. “And the long term trend for US industrials suggests that the positive bump associated with the Trump tax cuts has now worked its way through the system, and we’re now seeing some cracks appearing in the credit quality foundations.”

The Credit Benchmark CCI will be published monthly on the third Monday of each month.

To download the full CCI tear sheets for UK, EU (ex-UK) and US Industrials, please enter your details below: