If the Basel Committee on Banking Supervision implements its March 2016 proposals this year, banks will need to expand their historical default datasets in order to justify their Probability of Default (“PD”) estimates. One of the key challenges is the lack of relevant default data, and this is one of the reasons that the BCBS is keen to standardize the risk weights for large corporates – defaults do not happen often enough in those types of obligors to provide a history.

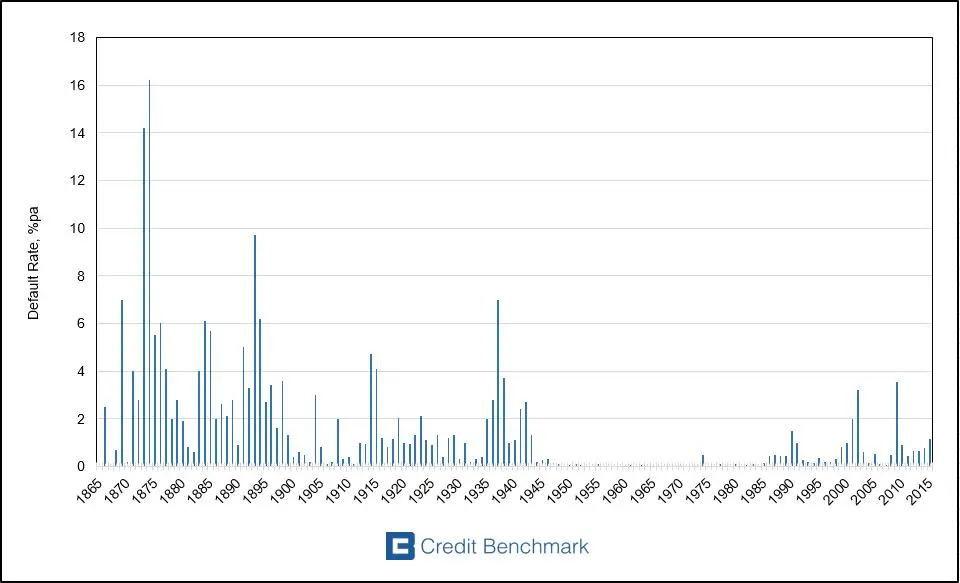

In March 2010, a team of researchers at the NBER published “Corporate Bond Default Risk: A 150-Year Perspective”. The paper covers US Corporate bonds (excluding financials) and provides some very useful context for the current debate about default histories. The paper shows that the long-run trend in corporate bond defaults has been down, but that defaults come in waves; six or seven of them, depending on how they are defined. In the 1860s and 1870s, the default rate reached a peak of more than 16% pa with an average annual default rate of 6%. The next wave in the late 1880s peaked at 9%pa, and at the height of the Great Depression it was 7%. The spike after the TMT bubble was about 3%. The paper also shows that, in more than 80 of those 150 years, the default rate was less than 2% pa. During the 1950’s and 1960’s, it was almost invisible.

The chart shows this NBER time series, updated with additional averaged data from Moody’s, S&P, Bank of America, Fitch and J.P. Morgan.

Research by these firms shows that the corporate default rate spiked after 2008 – some of them estimate that it peaked at 12%, (the average on the chart is significantly lower) before falling back to the 1% – 2% level for a few years. It has started to tick up again, with some firms estimating it as being as high as 3%, and some commentators have a very pessimistic view of the near future: Albert Edwards at Societe Generale has warned of a potential “tidal wave of corporate default” in the US.

Credit Benchmark data shows that banks have slowly but steadily increased their credit risk estimates for investment grade Corporate entities. So while corporate defaults may have been in trend decline for the past 150 years, the question facing banks and policymakers is whether this recent trend is just a short term blip, a ‘tidal wave’, or a more fundamental change?