When the world entered lockdown in early 2020 employers globally were forced to lock their doors, ushering in a new age of a stay-at-home workforce. Some doors will not reopen, with economic conditions being just too difficult. Millions of employees have lost their jobs, are on extended furlough, or have become remote workers amidst challenging and unfamiliar conditions. Company-led pastoral care initiatives have become critical; corporate policies relating to job security, support during illness and flexibility for working parents are under more scrutiny than ever before.

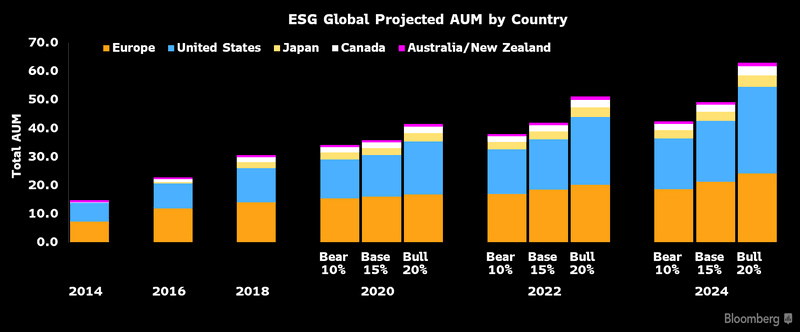

Social issues also took centre stage in 2020: the obvious reduction in urban pollution during early lockdown kept environmental issues to the fore, while Climate Change and Black Lives Matter protests went ahead despite government-dictated social distancing measures. The vocal and broadly-supported demonstrations of the last year have prompted many companies to evaluate and improve their own adherence to Environmental, Social and Corporate Governance (ESG) values. In tandem, investment into ESG-compliant funds grows exponentially. Bloomberg Intelligence estimates that global ESG assets under management will exceed $53trn by 2025, representing more than a third of the global total.

Figure 1: ESG Projected Global Assets Under Management

While an increased focus on ethical governance and improved employee support is good for society, the financial health of progressive companies is equally important to their investors and shareholders. Rapid growth in ESG investment suggests confidence in the profitability of green, social, and sustainable business – and new research from Credit Benchmark indicates that forward-thinking companies are also a better credit risk.

Fortune Magazine collates an annual list of the 100 best companies to work for, based on both employee feedback and company analysis. Employees are surveyed on their experiences regarding their job role, gender, race/ethnicity, payroll status and other elements contributing to their workplace experience, while the companies were analysed for their employee demographics and HR programs and practices. The latest survey gives special consideration to how well the companies have been supporting their employees during the pandemic.

Of the companies appearing on the 100 Best Companies list, 54% currently hold a Credit Consensus Rating (CCR) and these can be compared in credit quality against a list of UK Top 100 companies (comparative to the FTSE100 index) and US Top 500 companies (comparative to the S&P500 index) [please continue below to access full report].

Figure 2: Credit Risk Distribution for Best Companies / UK Top 100 / US Top 500