Risk isn’t always where you think it is. When you are dealing with any global institution, the risk doesn’t always reside with “the name over the door” – nor necessarily in the jurisdiction that you think you are doing business in.

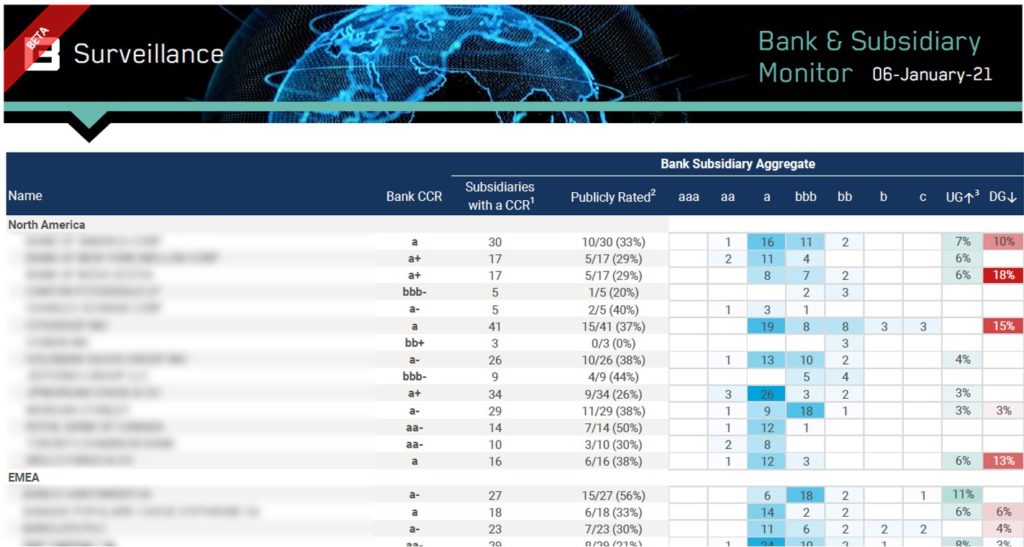

Understanding the exact legal entity that you have exposure to and the jurisdiction in which that entity operates is critical to those charged with protecting assets and managing risk. The new Bank & Subsidiary Monitor shows the Credit Consensus Rating for 35 of the world’s largest banks and prime brokers, as well as the credit distribution for 700+ subsidiaries underlying these firms – 65% of which are unrated by the major credit rating agencies or do not have a specific Credit Default Swap. The Bank & Subsidiary Monitor also demonstrates the detailed analytics that are available at a single entity level on any of the 45,000+ global entities with a Credit Consensus Rating, under license via our Web App, Excel add-in, API or flat-file download. The data is also now available via the Bloomberg Terminal. Please get in touch if you would like complimentary 30-day trial access.

Onboarding and monitoring where your risk lies is a huge logistical challenge, and your principals and investors understandably demand that you to demonstrate your ability to manage your counterpart risk accurately and efficiently. Demonstrate to your investors that you have the right information to your fingertips, and ensure you don’t miss alerts on the changing creditworthiness of your counterparts. Armed with this information, you can do more with less.