The automotive industry is undergoing a major transformation. Sales continue to grow at 2% – 3% pa, but environmental concerns and new technologies means a prolonged period of uncertainty and re-alignment for manufacturers, including the entrance of new technology suppliers and decline of legacy component providers.

Environmental drivers include the phasing out of diesel and the spread of low emission legislation; technological changes include the advent of viable, fast-charging long-distance electric cars and the introduction of self-driving software. But the timing and reach of these changes is still very uncertain.

This industry also has a complex global supply chain, making it particularly vulnerable to trade disputes and disruptions – including the looming Brexit deadline as well as Trump’s tariffs on imported cars, trucks and automotive parts.

Modern “cars” are wheeled computers, increasingly built by robotic factories running AI software and optimizing component inventories; and even predicting future potential mechanical problems within the manufacturing process.

For autoparts companies, the need to stay competitive and innovate during the current wave of technology change has prompted a wave of mergers and acquisitions. This has so far been good for credit quality and – in a number of cases – share price performance.

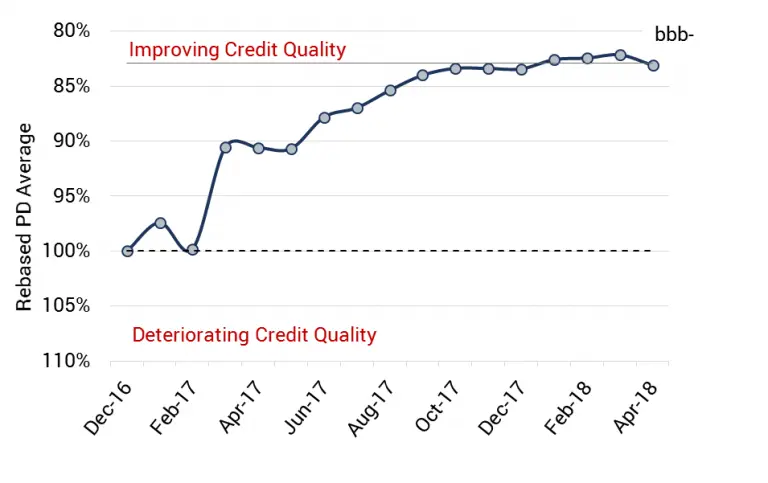

Bank-sourced data covers more than 60 global automotive companies and suppliers. As shown in the chart below, auto supply chain credit quality steadily improved from early 2017 to early 2018, moving from High Yield to Investment Grade on the CBC* scale in August 2017.

However, this trend appears to have slowed and possibly peaked with the most recent data showing a modest deterioration.

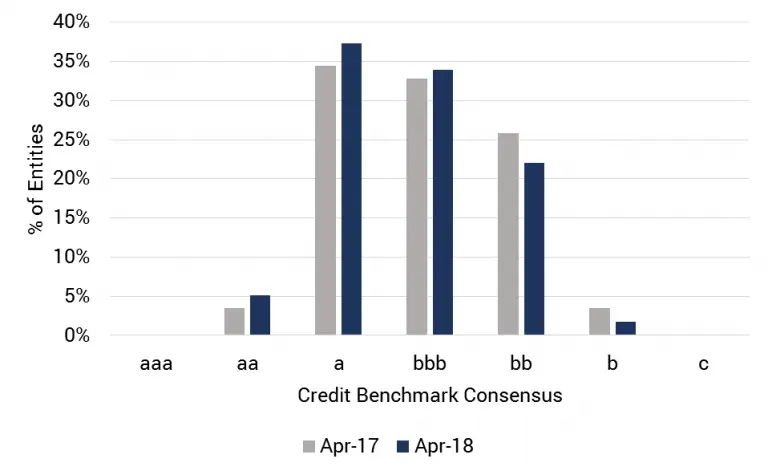

The impact of this improvement on the industry credit distribution can be seen below. This shows that the distribution has moved to the left over the past year, with significant numbers of autoparts companies making the transition from b and bb to bbb and a.

In credit terms, the global autoparts supply chain has adopted a defensive stance and this has improved industry credit quality; but with a steady stream of new entrants from the technology sector, and with the new shape of the industry still very uncertain, we can expect credit in this area to remain volatile.