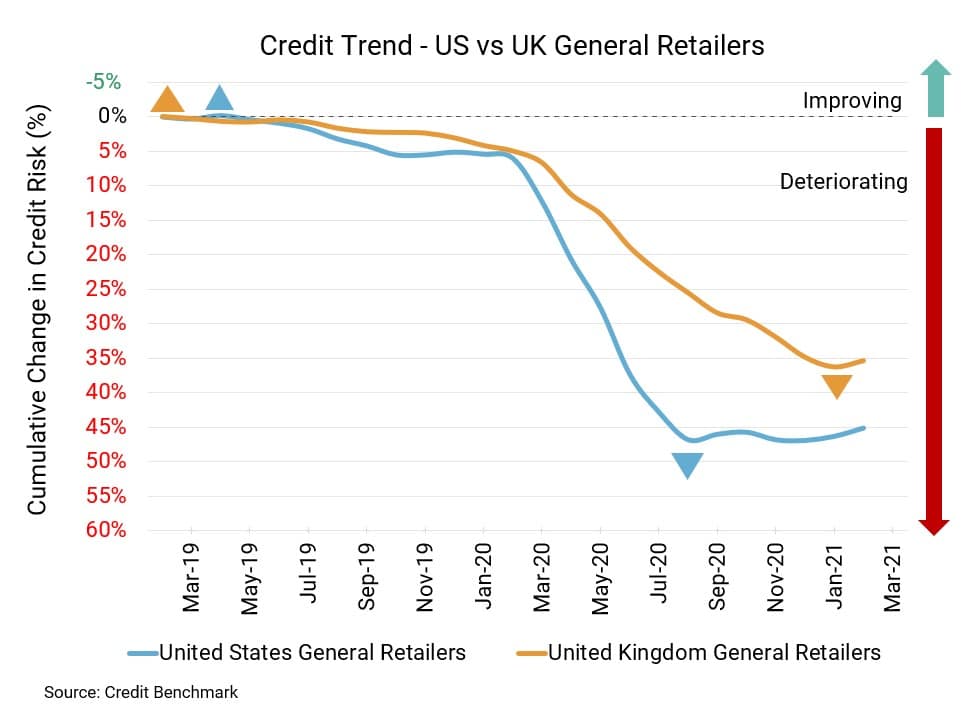

US Retail has remained relatively stable, according to Credit Benchmark consensus data.

Unlike other sectors whose default risk seems to be trending ever upward, US retail has seen its aggregate default risk level off in recent months. It remains lower than default risk for UK retail as well as Global Retail, and it is only marginally higher than default risk for the overall US corporate sector.

The tailwinds for the US retail sector are strong. The country continues to ramp up its vaccination efforts, and its various forms of fiscal and monetary support will likely provide a solid foundation for the near future. JPMorgan CEO Jamie Dimon stated recently he was optimistic an economic rebound could last at least two years. Fed Chair Jerome Powell was also optimistic even as he warned about lingering risks. Supply chain problems may be an obstacle for some firms, to the point where they may pay more to get items by air rather than by sea. Private sector spending data offer reason to be hopeful.

Overall, credit risk data for the US retail sector suggest reason for cautious optimism. Time will tell if the same can be said for the UK as well as the Global sectors.

Default risk for the US retail sector is elevated but stable. The latest data show credit deterioration of 37% year-over-year, yet recent trends have been more positive, with improvement of 1% over the last six months. Default risk remains at 67 bps, compared to 68 bps six months ago and 49 bps at the same point last year. Currently, 80% of firms have a CCR rating of bbb or lower, and this sector’s overall rating is bb+. Overall US corporate default risk is 65 bps and its CCR is bb+, with 81% of firms at bbb or lower.

Data for UK retail looks at least a little better than it did last month. The sector’s credit has deteriorated by 29% year-over-year and by 8% from six months ago, yet it has improved by 1% from last month. Default risk is still very high at 105 bps, but this is down from last month’s 106 bps. It was 97 bps six months ago and 81 bps at the same point last year. Now, 92% of firms have a CCR rating of bbb or lower, and this sector’s overall rating is bb. Overall UK corporate default risk is 82 bps and its CCR is bb, with 91% of firms at bbb or lower.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 55,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 90% of the entities covered are otherwise unrated.