.

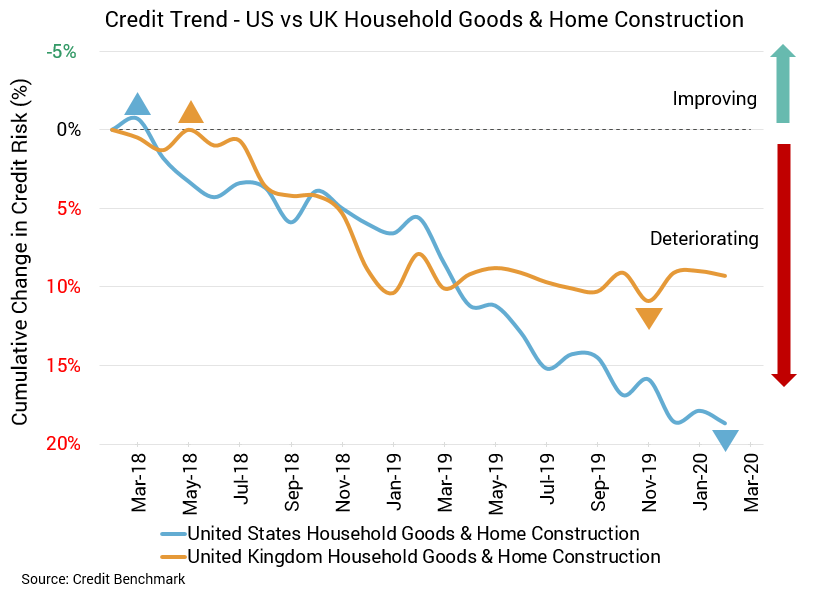

The economic devastation brought on by COVID-19 is sparing no sector and housing is no exception. While US and UK housing firms began the new year with some moderately positive credit news, that is now over. Both groups have seen credit deterioration this month, and the long-term negative trend is all the more pronounced for the US sector.

Unemployment is soaring, and this will put pressure on incomes and personal budgets. The effects of this are likely to linger for some time even after each country begins to return to normal, contributing to further deterioration or limiting gains. Significant improvement in credit quality may be a long way off.

Credit quality for US housing sector firms continues to worsen. While the month-over-month deterioration is only 0.6%, the year-over-year change is a much larger 12.4%. Average probability of default for these firms is currently 54.8 basis points, compared to 54.5 basis points in the previous month and 48.8 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) for this aggregate has remained at bb+ over the last year, yet as credit deterioration continues, the aggregate is moving closer towards a downgrade.

Credit quality for UK housing sector firms is also weakening. The month-over-month deterioration is 0.2%, while the year-over-year deterioration is 1.3%. With the most recent update, average probability of default for these firms is now 55.1 basis points, compared to 55 basis points in the prior month and 54.4 basis points at the same point last year. The current Credit Benchmark Consensus (CBC) for this aggregate has remained at bb+ over the last year. But as with the US aggregate, additional credit deterioration will push the aggregate towards a downgrade. It is already closer to this position than the US aggregate.

About Credit Benchmark Monthly Housing Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the household goods and home construction sectors. It illustrates the probability of default for a variety of companies in the home construction space as well as firms that would benefit from increased home building and buying. Worsening credit risk means a greater probability of default; improving credit risk means a reduced probability of default. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.