State-owned enterprises (SOE) in Africa play a vital role in their respective economies – managing natural resources, energy, transportation, and telecommunications – but they often rely heavily on regular capital injections from their governments.

South Africa

South Africa recently rescued Eskom, the state power monopoly, in the largest bailout in the country’s financial history. Eskom’s financial problems had led to years of neglected maintenance and rolling national blackouts, and the company was close to collapse. There are also challenges with Transnet, state airline SAA, and the South African Broadcasting Corporation. More here on economic challenges in South Africa from the Financial Times.

Nigeria & Ghana

SOE problems are not unique to South Africa: in 2018, Nigeria suspended plans to relaunch its national airline, seemingly because of the inevitable need for support from the Nigerian government.

Ghana has announced an Action Plan to tackle SOE governance, while the Electricity Company of Ghana has just been taken over by the Philippines-based Meralco, who have promised to invest $600m in transmission.

Foreign investment – to the rescue?

The Meralco example is one of many where foreign investment, especially from resource-hungry China, has come to rescue.

Concerns about Chinese influence in Africa are probably exaggerated – the growing number of Chinese/African joint SOEs have a good track record of delivering effective projects on time and budget. Africa accounts for only 6% of Chinese foreign direct investment (FDI) so there is considerable scope for more, although China’s current domestic and trade challenges are likely to lead to a pause in their global expansions plans.

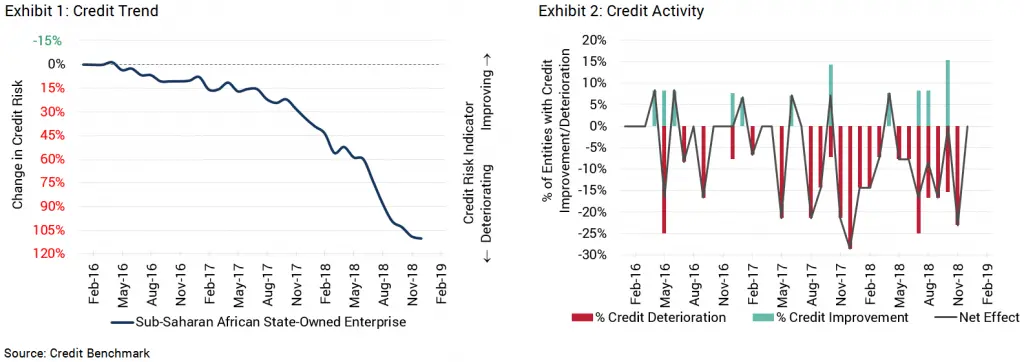

The charts below are based on Credit Benchmark’s credit risk data on 13 Sub-Saharan African SOEs, sourced from 30+ of the world’s leading financial institutions.

The Credit Trend chart shows that credit risk of the sub-Saharan African SOEs has more than doubled over the last two years. The Credit Activity chart on the right shows a negative bias in 9 out of the past 12 months.

Amongst the current challenges for African SOEs, they may need to fall back on their own resources, which could be a key driver in the current credit deterioration.