.

The pandemic era has not been kind to the energy sector, yet the situation may be looking a bit brighter. Oil forecasts from the IEA and IMF are improving, even if they are not back to pre-pandemic levels, due to more a more robust economic picture. An improving dynamic is showing up at the company level. In addition, a return to normal in other sectors will certainly help the energy sector.

Of course, demand and prices may come under pressure if pandemic cases rise or there are problems with vaccinations. In the US, there may also be lingering problems due to weather-related disruption earlier in the year. Natural gas has its own issues that are making it less competitive.

The global energy industry may not be out of danger just yet, but a better near future that eases stress on credit seems possible. The US energy sector certainly needs it.

.

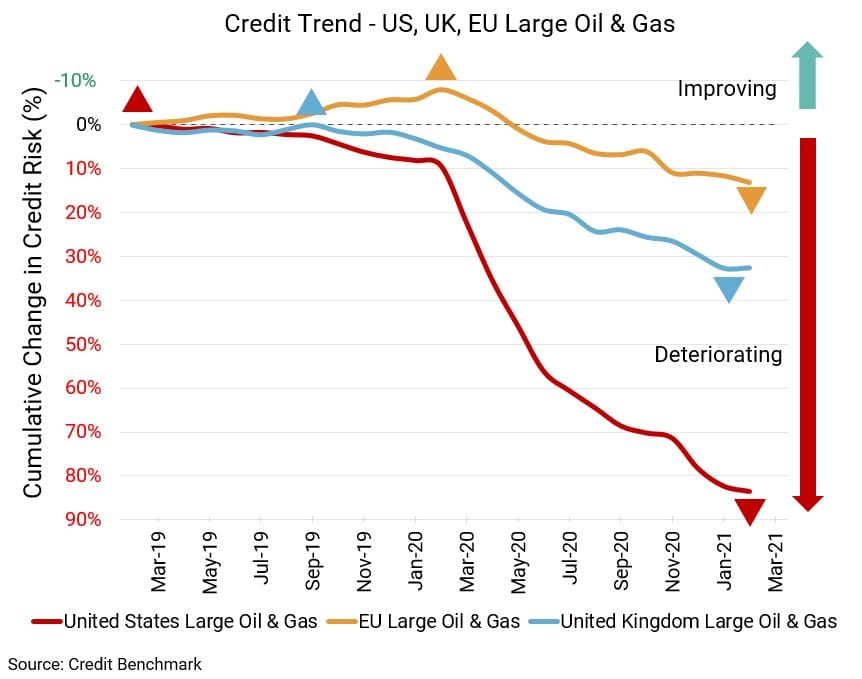

Deterioration for US Large Oil & Gas firms continues to be pronounced. Credit quality has declined by 68% over the last year, 12% from six months ago, and 1% from last month’s update. Default risk is now 77 bps, up from 76 bps last month, 69 bps six months ago, and 46 bps at the same point last year. This sector’s current CCR rating is bb+, and 86% of firms have a CCR rating of bbb or lower.

There’s also been deterioration for UK Large Oil & Gas firms, yet recent data has been more positive. Credit quality has dropped by 26% over the last year and 7% over the six months, but there’s been little change compared to last month. Default risk remains at 55 bps, compared to 52 bps six months ago and 44 bps at the same point last year. This sector’s current CCR rating is bb+, and 77% of firms have a CCR rating of bbb or lower.

The credit picture for EU Large Oil & Gas firms remains in superior shape compared to the US or UK aggregates. There’s been deterioration of 23% over the last year, 6% from six months ago, and 1% from last month. Yet default risk remains at just 29 bps, compared to 27 bps six months ago and 24 bps at the same point last year. This sector’s current CCR rating is higher at bbb, and 71% of firms have a CCR rating of bbb or lower.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.