.

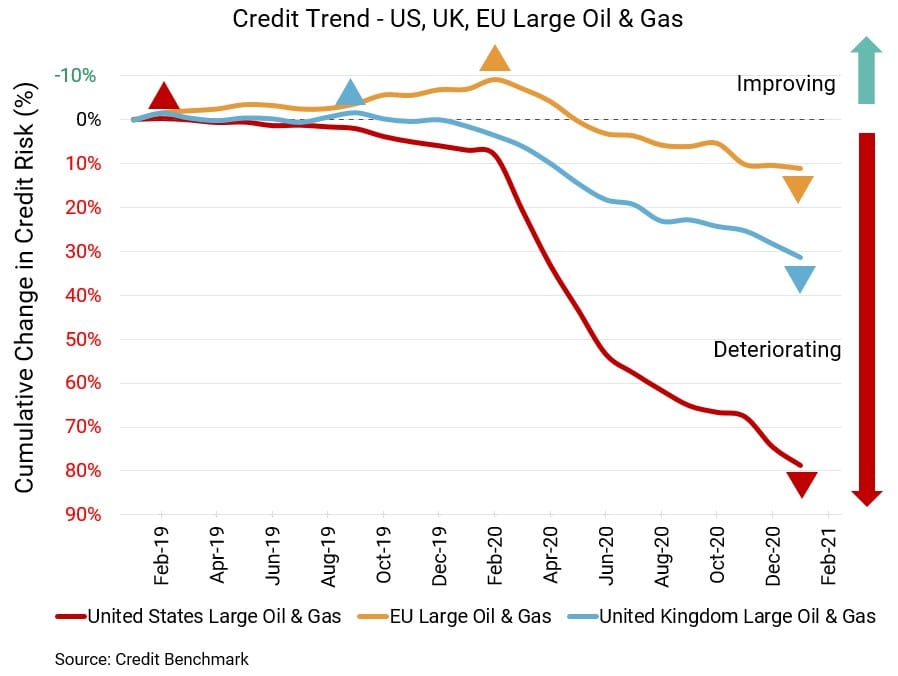

Default risk for US Large Oil & Gas firms remains far higher than default risk for comparative UK and EU firms. In fact, the US Oil & Gas aggregate has higher default risk at 75 bps than that of the Large US Corporates aggregate (56 bps), whereas the default risk for the UK and EU Oil & Gas cohorts remain lower than their Corporate aggregate counterparts.

Energy firms around the world have been challenged by COVID and changing consumption habits. The US has been hit particularly hard. There were over 100 bankruptcies in 2020, with predictions of further trouble this year and claims that the boom years are over. There may be a so-called drilling binge due to higher oil prices. A new clean energy focus in Washington could bring additional pressures, and US firms already lag behind their European peers in the green transition. On the positive side, demand for gas seems to be picking up.

Of course, the UK and Europe are facing pressures as well. The months ahead may be more positive than some anticipate, but the global energy industry is not yet out of the woods.

.

The relentless downward trend for US Large Oil & Gas firms continues. Credit quality is down 67% from the same point last year and 13% from six months prior, and 2% from one month prior. Default risk is now 75 bps, compared to 73 bps one month prior, 66 bps six months prior, and 45 bps at the same point last year. This sector’s current CCR rating is bb+, and approximately 86% of firms have a CCR rating of bbb or lower.

While in better shape than the US, UK Large Oil & Gas firms have also been trending down. Credit quality has fallen by 30% from the same point last year, 10% from six months prior, and 2% from one month prior. Currently, default risk is 55 bps, compared to 54 bps one month prior, 50 bps six months prior, and 43 bps at the same point last year. This sector’s current CCR rating is bb+, and approximately 76% of firms have a CCR rating of bbb or lower.

While not without difficulties, EU Large Oil & Gas firms remain in much better shape than their US or UK counterparts. Credit quality is down a much smaller amount, 19%, over the last year, down 7% from six months prior, and 1% from last month. Default risk remains at 28 bps, compared to 26 bps six months prior and 24 bps at the same point last year. This sector’s current CCR rating is bbb, and approximately 69% of firms have a CCR rating of bbb or lower.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.