Credit Benchmark have released the January Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The January CCIs show that a long continental trough may be nearing an end. After months of weak sentiment, the prospects for EU Industrials are looking better. News is less rosy but still improved for the UK and US Industrials sector.

Additional improvements in sentiment for EU, UK, and US Industrials are certainly possible but heavily dependent on a so-called return to normal. Greater adoption of a vaccine that will speed up the transition to that point is certainly a welcome development. The Financial Times reports AirbusSE CEO Guillaume Faury is “cautiously optimistic” about a recovery in aircraft after a big drop in sales in the last year. At the same time, Bloomberg reports that the global economy will face a new headwind in the form of higher shipping rates that will negatively affect supply chains. The months ahead will be critical in determining the longer-term credit health of the sector.

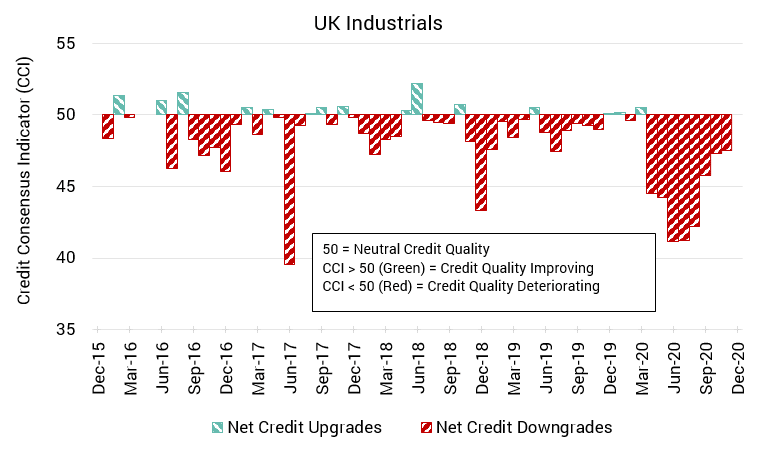

UK Industrials: Improving but Still Negative

The CCI score for UK Industrials is below 50 but much better than it was earlier in the year, when it took a sharp downward turn. From the March through July update, all scores were below 45.

The current CCI score for UK Industrials is 47.5, up from 47.3 last month.

Though the credit outlook for the sector is still a net negative, it has been gradually improving since the summer.

.

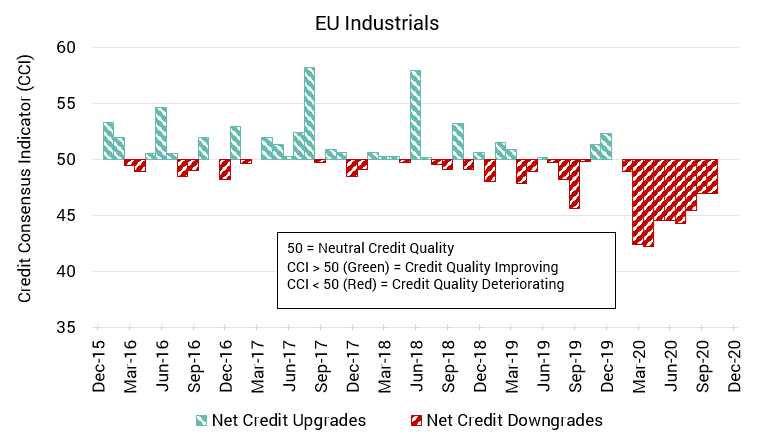

EU Industrials: A Slight Worsening

After nine straight months of net negative sentiment, there may be some light on the horizon for EU Industrials.

Credit sentiment for EU Industrials has shifted to neutral, ending the month with a CCI of 50, up from 46.9 last month.

This is the first time the outlook for the sector has reached this level since January 2020. In fact, from March through July, the EU CCI score was below 45, suggesting a particularly dour outlook for the sector.

.

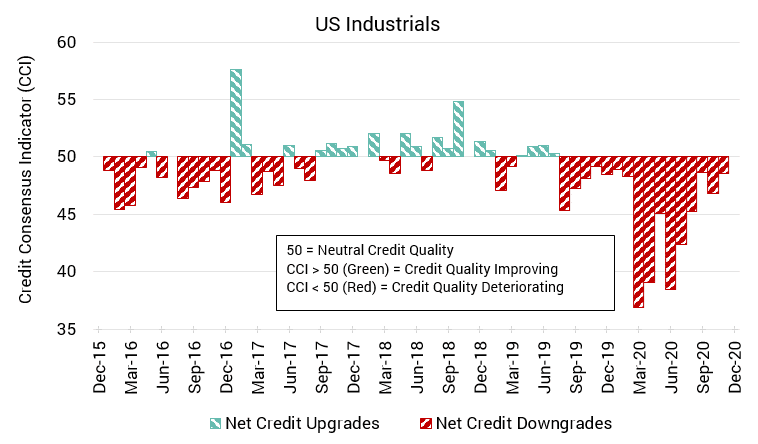

US Industrials: Volatility Remains

The outlook for US Industrials has been showing signs of intermittent improvement since the fall of 2020, even as the month-to-month CCI readings have been more volatile for the US than for the EU and UK.

The current CCI score for US Industrials is 48.5, up from 46.8 last month.

Though now showing promising upwards movement, the US Industrials sector outlook has been net negative for 16 straight months, including the current update. Some months, it went below 40, much lower than scores for the EU or UK.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: