.

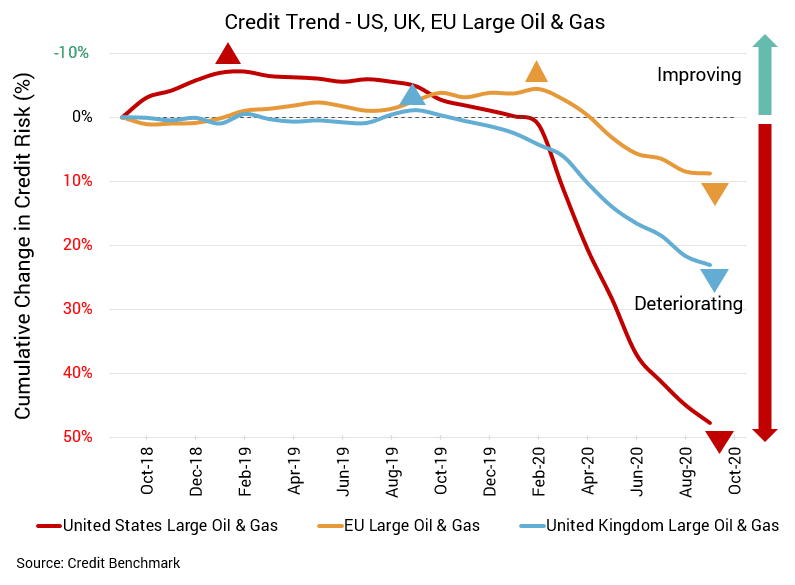

If there’s one major sector that has borne the brunt of problems during COVID, it’s the US energy sector. Credit quality deterioration may not be as pronounced in the UK or EU energy sectors, but similar industry strains exist in both. Prices remain below their pre-pandemic levels, and demand will likely remain weakened until normal transportation habits and schedules return. The threat of COVID remains ever-present.

.

Continuing declines in credit for the US energy sector are adding up. Compared to the prior month, credit quality for large US oil & gas firms is down about 2%. The longer-term picture is much worse, with quality down about 33% from six months prior and about 55% from the same point last year. Average probability of default is 56 bps, whereas it was 55 bps one month earlier, 42 bps six months earlier, and 36 bps at the same point last year. Approximately 81% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bb+.

The UK energy sector is also seeing its credit quality decline, but changes are more minor. Credit quality for large UK oil & gas firms has deteriorated around 1% from the prior month, yet it’s down about 16% from six months prior and about 25% from the same point last year. Average probability of default is 40 bps, while it was 39 bps one month earlier, 34 bps six months earlier, and 32 bps at the same point last year. Approximately 69% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bbb-.

Changes for the EU energy sector are less dramatic. Credit quality for large EU oil & gas firms is basically unchanged from the prior month, although it’s down about 12% from both six months prior and the same point last year. Average probability of default for this aggregate is much lower than it is for its US or UK counterparts. It’s now 25 bps, unchanged from the prior month, and compared to 22 bps six months earlier and at the same point last year. Approximately 66% of firms have CBC rating of bbb or lower. The aggregate’s average CBC rating is bbb.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.