Leveraged Loans continue to divide investor opinion. Values declined as part of the High Yield rout earlier this year, but they have been slower to recover.

Winnie Cisar, Head of Credit Strategy at Wells Fargo points to a simple lack of liquidity, which is only now filtering back into the Leveraged Loan space with prices closing the gap vs. general High Yield.

But there are genuine concerns that, in the coming months, default rates for Leveraged Loan issuers will be higher than for the overall High Yield universe, and these concerns are also reflected in the $760bn CLO market. Dan Fuss, Chairman of Loomis Sayles, is avoiding CLOs altogether because the component Leverage Loans are issued by companies that are too close to the troubles now facing Main St.

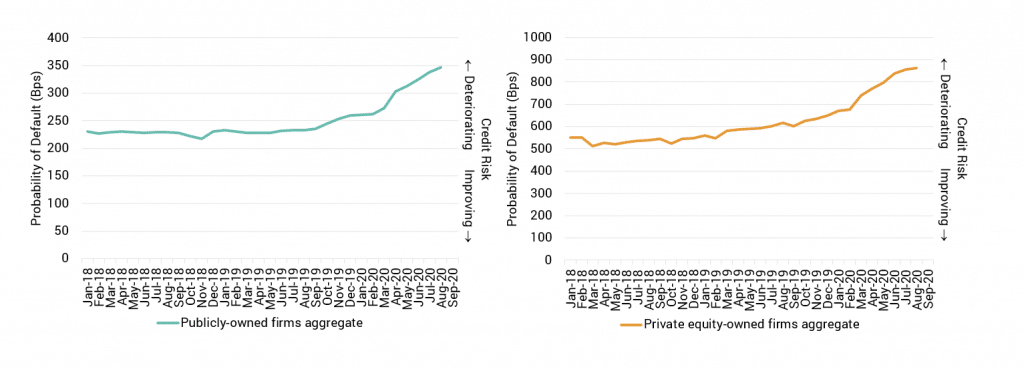

Figure 1 shows the recent trends in forward-looking consensus default probabilities for Public and Private Leveraged Loan issuers.

Publicly owned issuers (left) show steadily rising credit risk, with the average one-year default probability standing at around 350 Bps, up from about 230 Bps a year ago. Private issuers (right) seem to be stabilising at around 860 Bps, up from about 620 Bps a year ago. Public firms may be better credit quality, but their risks have risen faster than the Private firm sample and they are continuing to climb.

The largest holders of CLOs are Japanese banks, US Life Insurers, and US Banks. US Life Insurers, for example, hold more than three-quarters of their holdings in tranches rated at A- or better (although these represent only 3% of their $4.5trn in assets). But the CLO tranches that may hold unpleasant surprises may be skewed towards those with exposure to higher quality loans. This is consistent with broader consensus credit trends which suggest that some of the bbb and bbb- issuers may be in for a bumpy ride.