Download the Mid-August Industry Monitor infographic below.

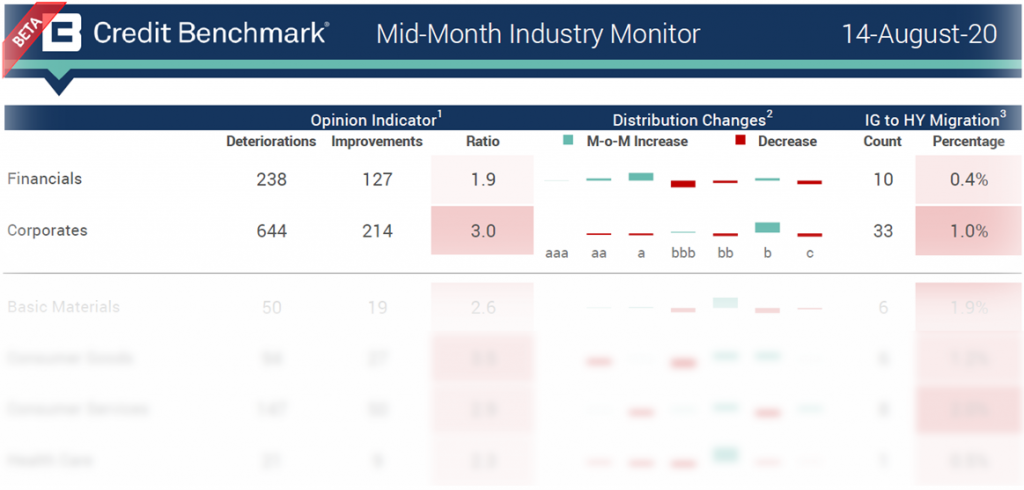

Credit Benchmark have released the mid-month industry update for August, based on a partial subset of the contributed credit risk estimates from 40+ global financial institutions.

In the update, you will find:

- Opinion Indicator: Assesses the month over month observation-level net downgrades or upgrades.

- Ratio: Ratio of Deteriorations and Improvements calculated as Deteriorations / Improvements

- Distribution Changes: The increase or decrease in the percentage of entities in the given rating category

- IG to HY Migration: The absolute and relative movement from investment-grade to high-yield

Compared to the figures seen in the July End-of-Month Update, the August Mid-Month Industry Monitor shows:

- The bias towards deterioration flagged by the opinion indicator ratio has decreased slightly for both Corporates and Financials (down from 3.7:1 to 3:1 for Corporates and down from 3.8:1 to 1.9:1 for Financials).

- Oil & Gas companies remain the worst performers, with a deteriorating/improving ratio of 4.8:1 (down from 5.5:1 in the last update).

- Telecommunications showed a very slight improving ratio last month, at 0.9:1 – the ratio has now reverted to negative, at 2.8:1.

- UK Oil & Gas companies are showing heightened levels of deterioration since end-July, jumping from a 2.2:1 deteriorating/improving ratio to now a 8.5:1 ratio.

- Travel & Leisure companies show a less severe deteriorating/improving ratio than seen in the last update (5.3:1, down from 12.4:1), but are showing a greater number of “fallen angels” (companies dropping from investment grade to high yield), at 4.4% (last update produced no fallen angels for this sector).

Credit Benchmark will continue to provide regular reports on these migration rates. If you have any questions about the contents of this update, please get in touch.

For full details, please download the Mid-August Industry Monitor infographic here:

Download Industry Monitor Update