Retail woes show no sign of stopping, particularly for the US. Joining chains like JC Penny, Brooks Brothers, and Sure La Table in bankruptcy are The Paper Store, Lord & Taylor, and Tailored Brands. Even with positive signs, like the second monthly increase in retail sales, optimism is hard to come by. The news is no better in the UK, with companies like Ben Sherman and Selfridges closing stores or cutting jobs. COVID-19 is still raging in the US, and new restrictions were imposed in the UK as cases begin to rise. Until the pandemic is under control, economists say, the economy can’t return to normal.

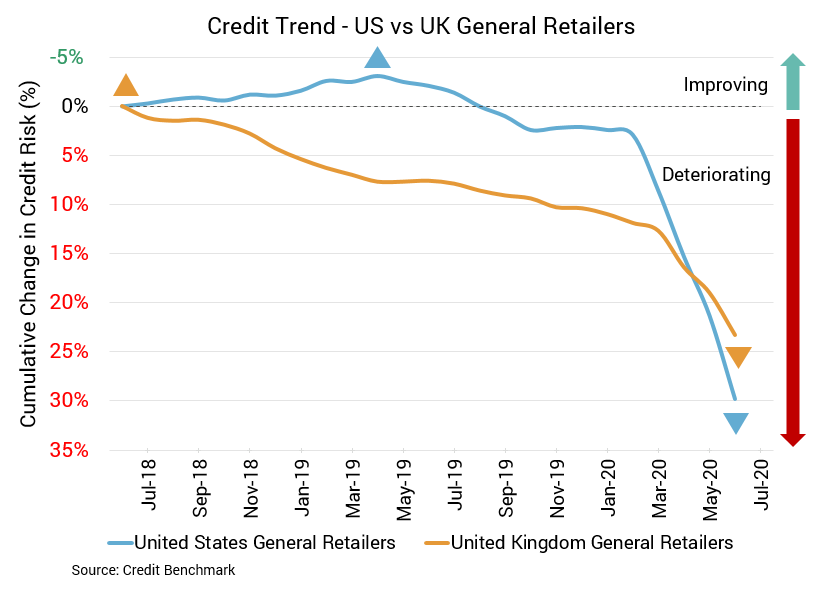

Credit quality for US general retail firms continues to sink and has been getting worse steadily since earlier this year. The latest update shows a drop of 8% from the month prior, 12.5% from two months prior, and 20% from three months prior. But the real inflection point came four months prior; since that point, credit quality has declined by 28.6%. Year-over-year, it’s down 35%. This drop in credit quality is reflected in climbing default risk. Average probability of default is now 54 basis points, compared to 50 basis points the prior month, 48 basis point two months prior, 45 basis points three months prior, and 42 basis points four months prior. At the same point last year, average probability of default was 40 basis points. Approximately 78% of firms this aggregate with a CBC rating are at bbb or lower with the most recent update, and the overall CBC rating for this aggregate is bb+.

Starting from a worse credit position than their US counterparts, UK general retail firms have also seen their credit quality declining – down by 4% from the prior month, 5% from two months prior, and 10% from three months prior. Year-over-year, credit quality is down 14.9%. Average probability of default for this sector is now 77 basis points, an increase from 74 basis points in the prior month, 73 basis points two months prior, and 70 basis points three months prior. At the same point last year, average probability of default was 67 basis points. As of the most recent update, about 92% of firms this aggregate with a CBC rating are at bbb or lower. The overall CBC rating for this aggregate is bb+.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 50,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 75% of the entities covered are otherwise unrated.