The impact of the Covid-19 crisis to the global financial network has accelerated the downward transition of creditworthiness at a rate comparable to the 2008 Global Financial Crisis. In the intervening 12 years, the credit markets have been relatively benign as Central Banks, regulators and policy makers have followed policies designed to achieve that objective.

Today, the world faces an uncertain and increasingly malign credit environment despite the efforts of the Governments around the globe to stabilise their economies.

In these turbulent times it is not surprising that the regulatory direction of travel has been towards encouraging stronger risk management within key financial networks and demanding more capital dedicated to support the key players and their counterparts. The forthcoming Basel IV regulations were conceived prior to the Covid-19 crisis and are a further step along that regulatory journey.

The scale of the challenge for the securities financing industry in preparing to meet this new regulatory framework should not be underestimated. The regulation will not just impact the regulated banking community but also have sweeping ramifications for all asset owners as well as for the broader capital market.

One of the new rules that will most affect the securities financing industry is the limitation on banks to apply internal rating models for Risk-Weighted Asset (RWA) allocation purposes. Additionally, the standardised rules state that unrated obligors will attract a 100% risk weight allocation. This affects tens of thousands of high-quality but unrated pension and mutual fund counterparties that most market practitioners think ought to attract a 20% risk weight instead.

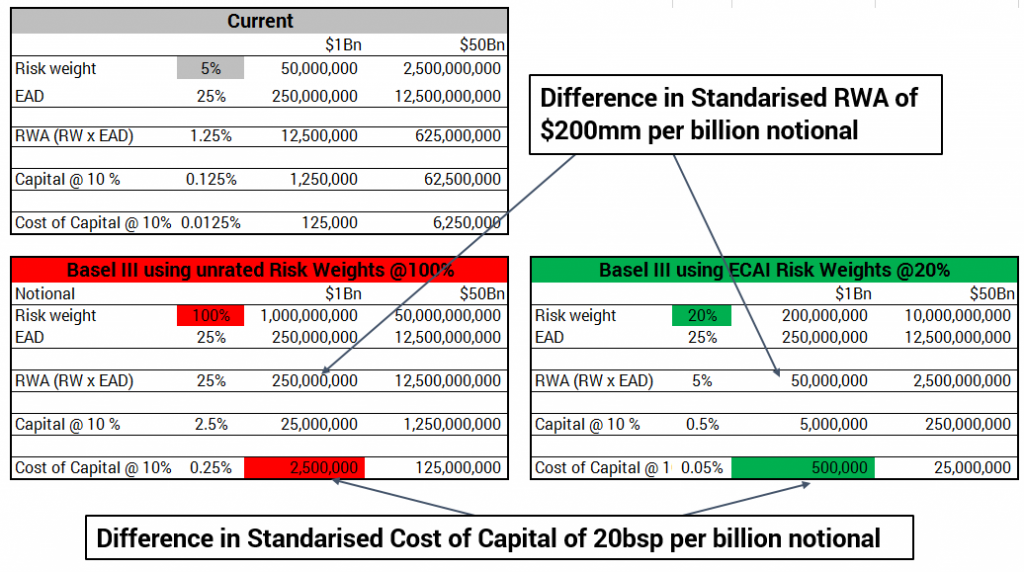

In this new paper from Credit Benchmark, it is estimated that the savings possible by the reduction of the cost of capital from a 100% risk weight to a 20% risk weight to be 2 million USD per notional 1 billion USD of exposure.

The basis of this estimation and the underlying assumptions are outlined below in Figure 1 – making this issue too expensive to ignore.

Such a dramatic increase in the cost of doing business for those impacted by the forthcoming regulations could result in a collapse in securities financing activity, with potentially severe consequences across the capital markets. Hence it is imperative that the industry finds solutions to the challenges that the Basel IV rules will pose.

A potential solution to this dilemma is the regulatory-approved use of alternative sources of credit data to supplement the gaps in the “issuer paid” credit rating agency model. External Credit Assessment Institutions (“ECAIs”) are a possible source of alternative credit data.

The purpose of this paper is to help raise awareness of these regulations, to highlight their potential impact and to issue a call to action.