The global economy is in “a synchronized slowdown”, according to the IMF’s latest World Economic Outlook report. Global growth for 2019 is expected to drop to 3%, similar to the rate seen during the global financial crisis. Trade in particular is suffering as a result of the prolonged US-China tariff war.

Not all industries are affected equally during times of economic sluggishness, and certain divergences are evident. The services industry has shown resilience, with the PMI for the sector staying afloat whilst the manufacturing PMI steadily deteriorated and dropped below 50 earlier this year[*].

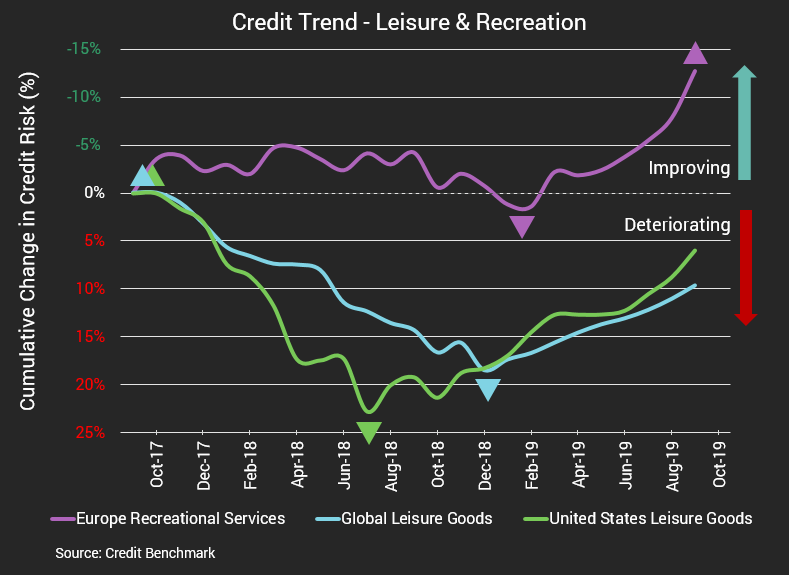

And while the ‘retail apocalypse’ has led to high-profile store closures in the UK and US, not all areas within the goods and services industries have been equally affected. Leisure providers have seen significant credit quality improvement in the past 12 months, as demonstrated in the Leisure Goods category, as well as in Recreational Services. Leisure Goods[†] globally have seen a 7% improvement year-on-year, whilst US companies in particular have improved by 17%. Recreational Services[‡] have shown even stronger improvements in credit quality, with an already healthy trend line for European (including UK) companies recently improving by a further 14% since early 2019.

The drivers behind this strong performance are multi-faceted. The ‘Wellness’ industry is booming, growing by an average of 6.4% between 2015-2017 compared with global GDP of 3.6%. An emphasis on health and fitness has been a boon for gyms and leisure centres, and athleisure has become a phenomenon in the apparel industry, projected to grow to a $350 billion market globally by 2020. Recent major sporting events such as the Football, Cricket, and Rugby World Cups will also have fuelled a greater interest in both viewing and participation amongst consumers.

This evident prosperity in the face of negative economic forecasts may have some correlation with the ‘lipstick effect’ theory – that is, when things become financially tough, consumers take comfort from smaller, more affordable purchases. Taking a trip to the cinema, purchasing a game to play at home, or eating out with friends are all more accessible ways to experience a small taste of luxury than shopping for a new car or going on an overseas holiday. There are some parallels with the past – a 1975 article from the New York Times captures the spirit of a nation experiencing an economic downturn: “The country may be in the depths of the worst recession since World War II, but, despite the lean times, a lot of Americans are still having fun”.

If predictions of a

forthcoming global recession materialize, the Leisure and Recreation industries

seem well placed to roll with the punches.

[*] IMF World Economic Outlook Report, October 2019, page 4 (https://www.imf.org/en/Publications/WEO/Issues/2019/10/01/world-economic-outlook-october-2019)

[†] The Leisure Goods companies captured in this aggregate include sportswear, sporting goods, wearable tech, toys and games, pool & spa companies

[‡] The Recreational Services companies captured in this aggregate include sporting institutions, arenas, and tournaments, fitness clubs, live entertainment providers, theaters, gaming companies