India is the fifth-largest economy in the world (close to $3trn), but with a population of 1.3bn and an average wage of just $2,100 p.a. it ranks 142nd on GDP per capita.

Much of the Indian population are financially disenfranchised. Until 2014, only 35% of the nation’s citizens had a bank account, and an estimated 50% are currently employed in the informal economy. Since the election of the Modi government in 2014, reform has been underway to provide better access to formal credit and banking products for the average citizen. Hundreds of millions of basic accounts have since been opened, and the creation of a centralised credit intelligence database is intended to offer greater visibility for lenders on a large potential customer base.

The economy will clearly benefit from the unlocking of private cash reserves, but in macro-terms, the Modi government has a long way to go to repair and integrate a fragile banking and finance system. Bad debt has limited lenders from taking on new business, and with a non-performing loan ratio currently at 9.3% of total lending, India ranks the worst among the top 10 economies. Economic momentum is slowing across the board – the second quarter of 2019 saw GDP growth drop to 5%, representing a six year low, and the economy has decelerated for five consecutive quarters. And while businesses have had reason for cheer at the recent announcement of corporate tax cuts, there have been no fiscal measures to boost consumer spending power.

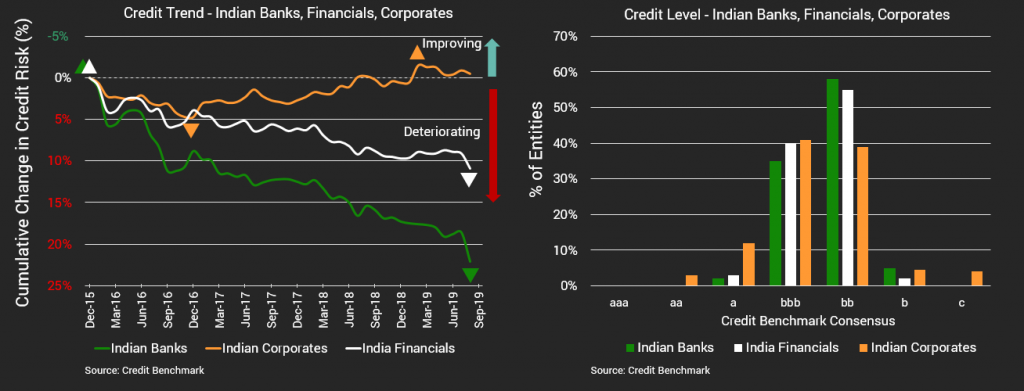

This systemic fragility may be one of the reasons for the atypical relationship between the credit trends and quality of Indian Corporate and Financial entities. Credit Benchmark data, sourced from leading global financial institutions, shows a steadily deteriorating trend line in the credit quality for Indian Financials and Indian Banks, dropping by 11% and 22% respectively since late 2015. Indian Corporates, while not exactly flourishing, have seen a much smaller dip and more recent improvement than their financial peers. International comparisons show that Italy and Brazil are the only other countries where Corporates, as a group, demonstrate better credit quality than their Financial peers.

High-profile defaults such as that of high-rated Indian shadow bank IL&FS have strengthened calls for increased scrutiny in the financial sector. Partly in response, the government plans to consolidate 10 state banks into four larger entities, making the bad debt burden more manageable and increasing new loans across the economy. Greater overall transparency into counterpart credit risks could reduce the risk of further debts; consensus credit risk data offers an alternative view across Indian Financials and Corporates at the entity and aggregate level.