Cracks are beginning to show in the foundations of the US Housing market, with the National Association of Realtors reporting a reduction of 4.4% in total sales from a year ago, and a rising housing inventory up by 3.6% in the same year. Excess housing stock plus falling sales is an unwelcome combination for vendors, and data from real estate brokerage Redfin shows that property offers subject to bidding wars dropped from 60% down to 15% between April 2018-April 2019.

Consumer confidence has been dealt a blow by the ongoing US/China trade wars, and the housing market is one of many sectors feeling the pinch. Rob Dietz, chief economist at the National Association of Home Builders told MarketWatch “We estimate that the 25% rate on the existing tariffs represent a $2.5 billion annual tax increase for the housing sector in terms of materials used for construction”. Tariffs affect a wide range of everyday goods, and rising living costs can also mean that renters or mortgagees have less available cash to fulfill their housing payment obligations.

Home buyer demographics are also in flux. Millennials may well aspire to home ownership, but ballooning student debt levels coupled with high rent can preclude young buyers from affording a down payment. Added to this, a generational lifestyle preference for the convenience of inner city living – at a price – and later ages for traditional home buying catalysts like marriage and children.

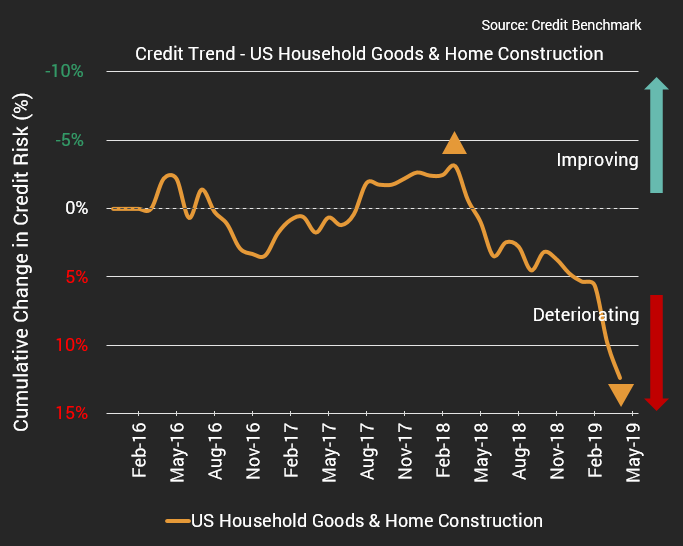

Credit Benchmark consensus credit risk data, sourced from 40+ global financial institutions, shows that lenders have been bracing for credit quality deterioration in the US housing sector for some time now. Credit quality for US Household Goods and Home Construction companies has dropped by over 7% in the last three months, and by 9% since October 2018.

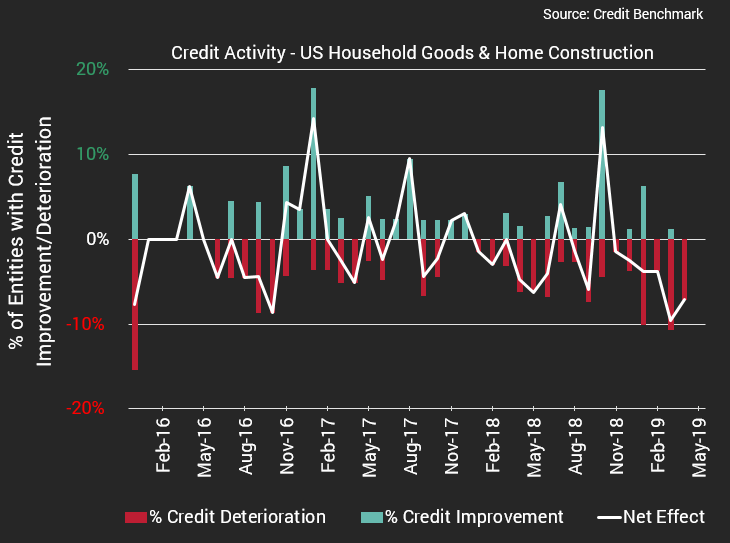

The number of month-on-month credit downgrades has also steadily increased, with 10 of the past 12 months showing more credit downgrades than upgrades, and the percentage of total credit downgrades roughly doubling in this time period.

While market conditions are not at the level of the 2008 housing crisis, the economic uncertainty currently affecting a number of sectors has undoubtedly been felt by the US Housing market.

To download the full aggregate analytics for US Household Goods & Home Construction, please enter your details below: