Credit Benchmark has published the latest monthly credit consensus data (from September 2018), with 28 contributor banks. The set of bank-sourced credit views (CBCs*) now covers more than 22,500 separate legal entities.

The monthly upgrades and downgrades overview is now based on data adjusted for changes in contributor mix.

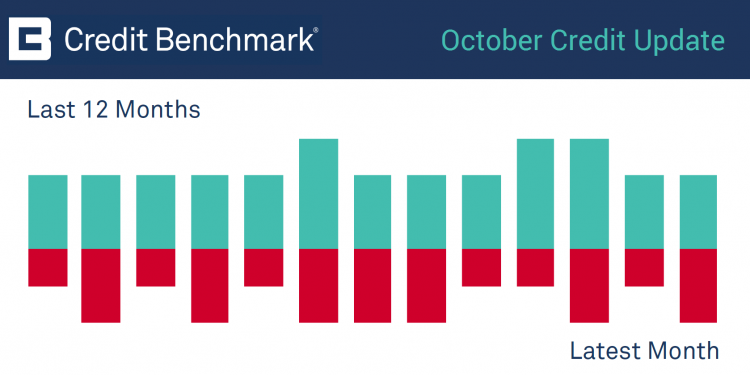

Monthly consensus upgrades and downgrades:

Last month showed improvements across 204 obligors and deterioration across 163, with 50 moving by more than one notch.

Industries:

* CBC = Credit Benchmark Consensus; a 21-category classification which is explicitly linked to probability of default estimates sourced from major banks. A CBC of bbb+ is broadly comparable with BBB+ from S&P and Fitch or Baa1 from Moody’s.

Disclaimer: Credit Benchmark does not solicit any action based upon this report, which is not to be construed as an invitation to buy or sell any security or financial instrument. This report is not intended to provide personal investment advice and it does not take into account the investment objectives, financial situation and the particular needs of a particular person who may read this report.