It has been a positive month for the most part for the credit quality of Global Financial counterparts, with a handful of exceptions.

Amongst the banks, Latin America Banks had the strongest showing, with an improving to deteriorating ratio of 7:1. Globally Systematically Important Banks (GSIBs) showed the most overall instances of improvements, but the ratio was tempered by deteriorations, with the final ratio being 2:1. Central Banks were the lone net negative performer this month, at 1:3 improvements to deteriorations.

The Intermediaries were wholly positive, with Central Clearing Counterparts (CCPs) showing no instances of deterioration. Broker Dealers had the strongest positive ratio at 2.7:1, while Prime Brokers showed the most overall instances of improvements, though with a slightly lower positive ratio of 2:1.

Buy Side Managers performed more modestly, with Asset Managers at 1.3:1 and Insurance Companies at 1.2:1. For Buy Side Owners, the news was worse – all three groups saw net deterioration, with Pension Funds the worst affected at 1:2.1 improvements to deteriorations.

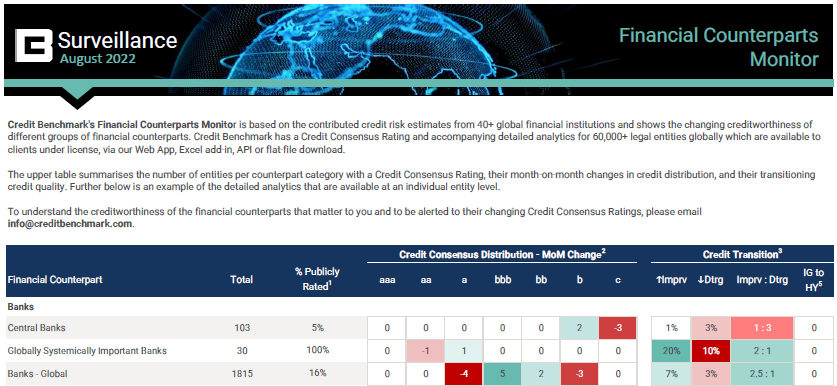

The Financial Counterpart Monitor from Credit Benchmark provides a unique analysis of the changing creditworthiness of financial institutions. The report, which covers banks, intermediaries, buy-side managers, and buy-side owners, summarizes the changes in credit consensus of each group as well as their current credit distribution and count of entities that have migrated from Investment Grade to High Yield.

The data, which is based on the credit risk views of Credit Benchmark’s contributing financial institutions, is also available at the legal entity level. Users of the data can monitor and be alerted to the changing credit consensus of their financial counterparts.