Much of the Leisure Goods sector was hit hard by Covid, especially during the draconian early lockdown phases. While lockdowns have eased, some social distancing has persisted. Golf equipment, boats, tents and caravans have done well, outpacing indoor sports; but growing supply chain problems are a threat to the winter holiday season, and to toy sales in particular.

According to the National Retail Federation, overall US retail sales have bounced back from the depths of the pandemic, and within this US Sporting and Leisure goods show modest improvement. However, Reuters report that the recovery in overall UK retail sales has been more subdued and volatile.

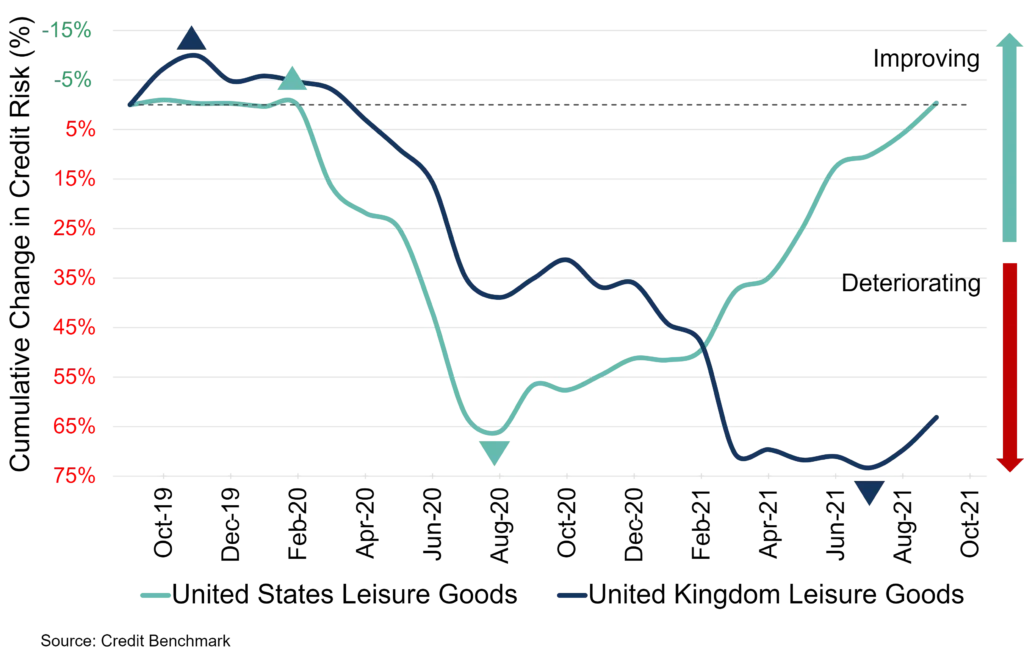

Figure 1 shows the credit trends for Leisure Goods in both regions.

In the US, Leisure goods credit quality started to recover in late summer 2020 and have consistently strengthened since then. The UK languished, flatlining in spring / early summer 2021; improvement has been modest following the easing of restrictions in Jul-21 [please continue below to access full report].