The US Midterms have been claimed as a victory by both sides, but Trump and Pelosi were both quick to propose a bipartisan approach with a likely focus on infrastructure , trade and healthcare.

The Dow jumped on the result, with the expectation of a second, spending-based fiscal boost for the domestic economy as well as some softening of the trade stance before any international backlash gathers too much momentum.

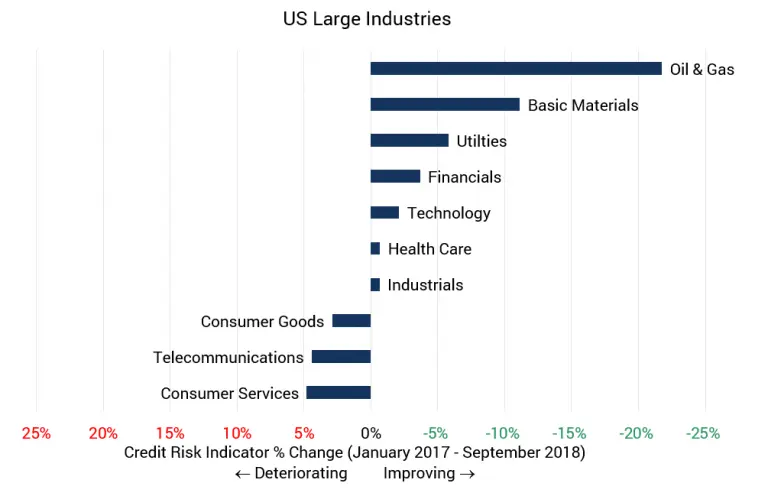

The chart shows that USA Inc. has seen some major credit improvements while the GOP has had full control of Congress. Oil & Gas is at the top, with its 25% improvement mainly driven by the global oil price recovery, but improvements in Basic Materials, Utilities and Financials are more directly linked to Trump policies. Previous Credit Benchmark research showed that the “Trump Effect” has been real and far-reaching.

The deterioration in Consumer and Telecoms industries highlights the recent fiscal focus on business as well as the impact of the “Retail Apocalypse”.

But commentary this week suggests a growing optimism that increased Democrat influence will be good for basic consumer spending. If Trump can find common ground with the Democrats, then a second wave of the “Trump Effect” is a real possibility.