Recent UK sales data shows continued weakness. Rising costs and weak demand has led some chains to consider closing stores (Debenhams, New Look) while others have fallen into administration (Toys R Us, Maplin).

In a newly published report, Credit Benchmark shows that these trends have been well anticipated by the credit analysts at some of the largest international banks. In an extract from the report, Exhibit 1 and 2 show credit risk trends and the credit distribution for 370 large UK companies in the General Retail sector.

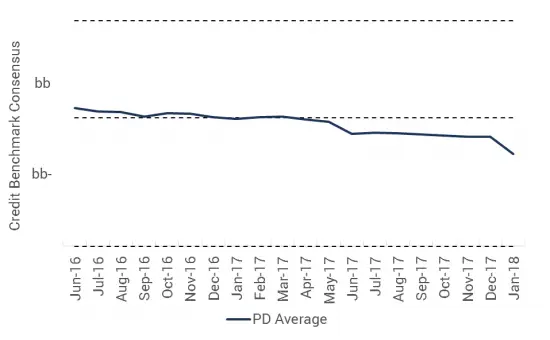

Exhibit 1 Credit risk trend – UK General Retailers

This shows that the credit risk of UK General Retailers has been increasing over the last 20 months, and the sector was downgraded from bb to bb- in April 2017.

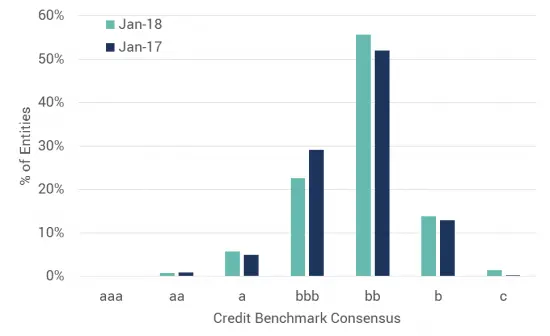

Exhibit 2 Credit risk distribution – UK General Retailers

The distribution shows that more than 70% of the UK General Retailers are viewed as non-investment grade in January 2018, an increase from 65% in January 2017.

For more detail, download the full report here.