The UK pension industry has been grappling with the combined challenges of increasing life expectancy and unnaturally low interest rates. The spike in energy costs and COVID disruption to supply chains means that the global interest rate cycle appears to have turned. This has had a particularly acute impact in the UK, where DB (Defined Benefit) and DC (Defined Contribution) schemes had turned to LDI (Liability Driven Investment) strategies to avoid notional funding deficits.

The LDI approach spawned an asset management boom in target date funds, which in some cases used leverage to convert 30-year bonds into longer duration hedges. Rising gilt yields have led to margin calls – with many funds holding insufficient cash to make immediate payment. Those funds do have other assets – bonds, equities, property; and ironically, they also have an improved long term funding position due to a drop in liability values following the rate increase.

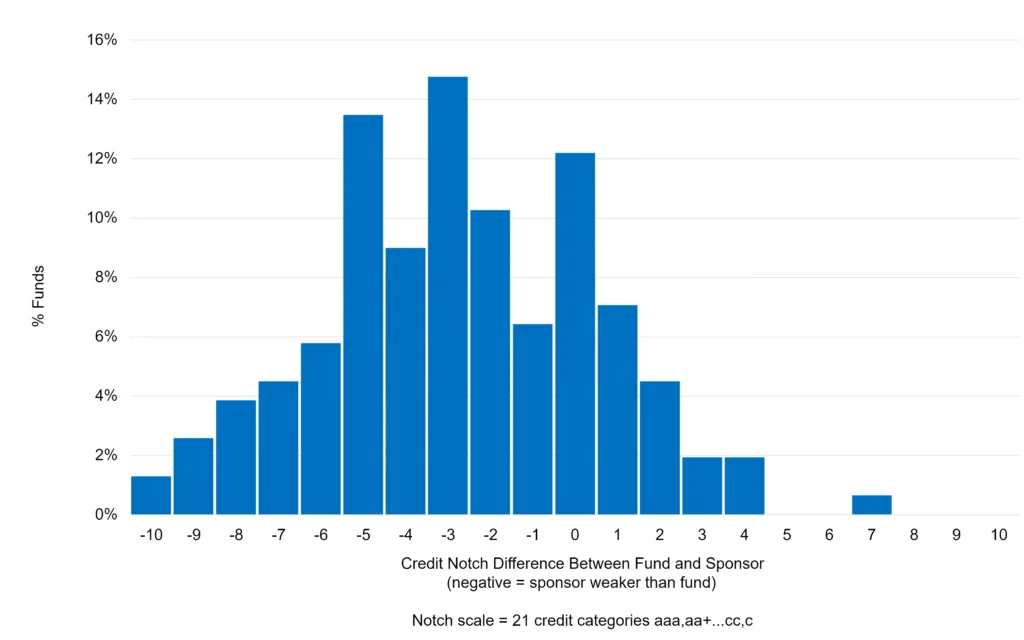

In the short term, however, they need to sell assets, or ask their sponsor for a cash injection – or reduce their swap exposure. Figure 1 shows the relative credit standing of about 150 UK DB schemes compared with the credit risk of their sponsor.

Figure 1 UK DB Schemes Credit Risk vs. Sponsor Credit Risk

Pension funds are traditionally well capitalised and bank consensus ratings usually show them as investment grade. Many of the companies that sponsor those funds are weaker credits, and a significant number are non-investment grade. This means that most DB pension funds in this sample – some of the largest in the UK – cannot rely on their sponsors for cash support to meet margin calls. This leaves them with the options of a rapid reduction in swap positions (leaving their liabilities unhedged if long rates start to fall again) or forced asset sales, skewing their asset allocation and potentially compromising their long-term funding. Ironically, higher long rates are good for funding as liabilities drop. The challenge is to monetise that improvement to meet margin calls.

This is an excerpt from the whitepaper; ‘Q3 2022 Credit Review: Inflation and Credit Risk: Close to Boiling Point‘, which can be read here.

If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 60,000+ public and private global entities, please complete your details to book a demo: