Volkswagen Sees Credit Upgrade as Transition to Electric Vehicles, Speculation of a Porsche IPO Revs Up

The auto industry was t-boned over the last year as transportation and consumption habits changed dramatically. Overall credit risk in the auto industry is still far higher than it was last year on a global and regional basis. But not all auto industry firms have been affected the same way. In fact, some have even seen their credit quality improve throughout the crisis.

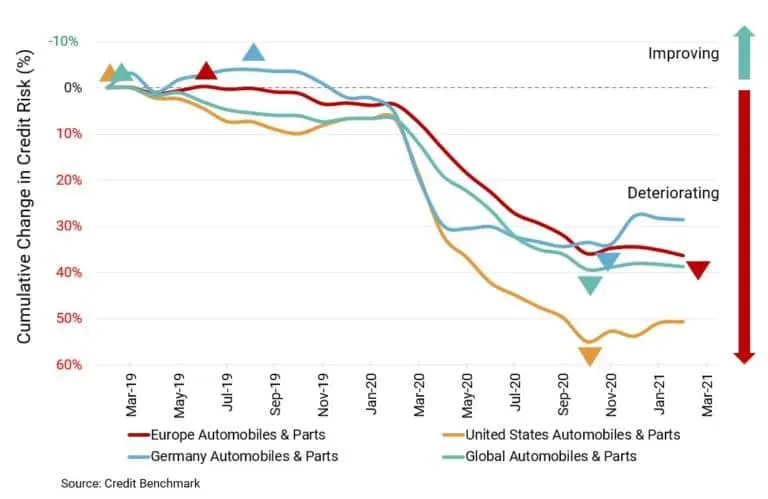

Auto Sector Default Risk Surges

Over the last year, credit risk surged for the Global auto sector by 30% to 53 bps, and its Credit Consensus Rating (CCR) rating is now bb+. Regional subsectors also saw double-digit increases in credit risk, but there are still wide disparities. Default risk for the US and Asian auto sectors is now 51 and 44 bps, and their respective CCR ratings are bb+ and bbb-. The overall European auto sector’s default risk is now 59 bps and its CCR is bb+, far better than the 85 bps and bb for UK firms. But the real standout is the German auto sector whose default risk is just 23 bps and whose CCR is still investment-grade at bbb.

Figure 1: Credit Trend – Europe, Germany, United States and Global Automobiles & Parts

Of course, not all companies are experiencing the same fate [see credit movement matrix in Figure 2 – please continue below to access full report].

Figure 2: Six month credit levels and changes for Global Automobiles

Credit Benchmark data is now available on Bloomberg – high level credit assessments on the single name constituents of the sectors mentioned in this report can be accessed on CRPR or via CRDT . Get in touch with us to request your free trial for Credit Benchmark Premium Data and Analytics on Bloomberg.

Please complete your details to continue reading this report: