Private insurers to become increasingly selective in financial crisis

The Trade Credit Insurance market currently handles about $2trn of revenue at risk annually. Most of this is focused on smaller companies that may be critical suppliers or buyers, but who also represent significant risks for operational or credit reasons. Some of these risks may arise from the supplier / buyer’s own company profile (such as debt levels) or may be driven by their sector or geographic location.

The 48 members of the International Credit Insurance and Surety Association accounts for 95% of private credit insurance around the world, and about 75% of this is handled by three firms – Euler Hermes, Coface and Atradius. During this crisis, these firms will be increasingly selective about the risks that they can commercially accept, and will need to charge materially higher premiums*. Companies may have to do their own due diligence on their suppliers and buyers; effectively self-insuring.

Credit Benchmark can provide extensive credit estimates on single companies, based on the views of analysts across a large number of financial institutions. This data also gives insight into industry, sector and regional credit trends and comparisons.

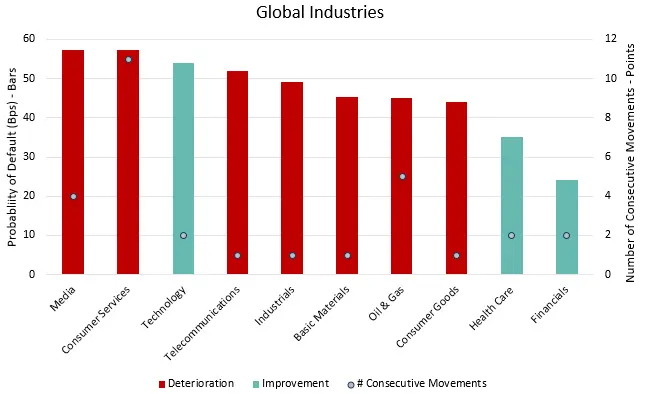

The chart below depicts the average probability of default and recent historical trend in credit quality for each of the major Industry Groups. Download full report below to see the global sector level data and analysis for 39 separate sectors.

Global Industry Level Credit Risk

At the industry-level, Media, Consumer Services and Oil & Gas are among the most vulnerable. At the sector-level (see full report), the data shows that Industrial Metals & Mining, Travel & Leisure, Food & Drug Retailers, Leisure Goods and Media are in the weakest positions.

Figure 1, above, shows that 7 of the 10 industry sectors tracked by Credit Benchmark were experiencing credit quality deterioration heading into the coronavirus crisis. The Media industry has the highest overall probability of default, currently more than 57 basis points, and credit quality in the industry has been deteriorating for the last 4 months. Its current Credit Benchmark Consensus rating is bb+. The Consumer Services industry follows closely, with an overall probability of default of around 57 basis points and an 11-month trend of consecutive monthly deterioration in credit risk. Its Credit Benchmark Consensus rating is bbb-. The Oil & Gas industry is also showing significant signs of vulnerability, with an average probability of default of 45 basis points, following 5 months of deteriorating credit quality. The Credit Benchmark Consensus rating for the Oil & Gas industry is bbb-.

Figure 2 (within full report) shows the global sector level data. Download full report below to see the global sector level data and analysis for 39 separate sectors.

.

Access the full report on ‘Trade Credit Risk: Which Sectors Are Most Vulnerable During the Virus Crisis?’ here:

*Trade credit pricing varies considerably depending on the circumstances, but the usual range is 10 – 30 bps for about one year of cover. For certain risks, the pricing can be much higher – 100 bps or more. In the current environment, if trade credit is still available, the pricing will be significantly higher.