Recent stock market declines have been led by Technology stocks. In early October, Apple became the first company in history to reach a market value of $1trn; but since then the combined market cap of the FAANG* stocks has lost more than that amount. Apple, in particular, is now officially in bear market territory. Investors were initially rattled by stalled sales of the newest iPhone model; but the sell-off rapidly extended to social media stocks, online retailers, chip manufacturers and online payments companies. This is the first time that all 5 FAANGs have been in a bear market at the same time, reflecting the combined headwinds of peak iPhone, data ownership, tax treatment, tech company governance and even possible anti-trust action.

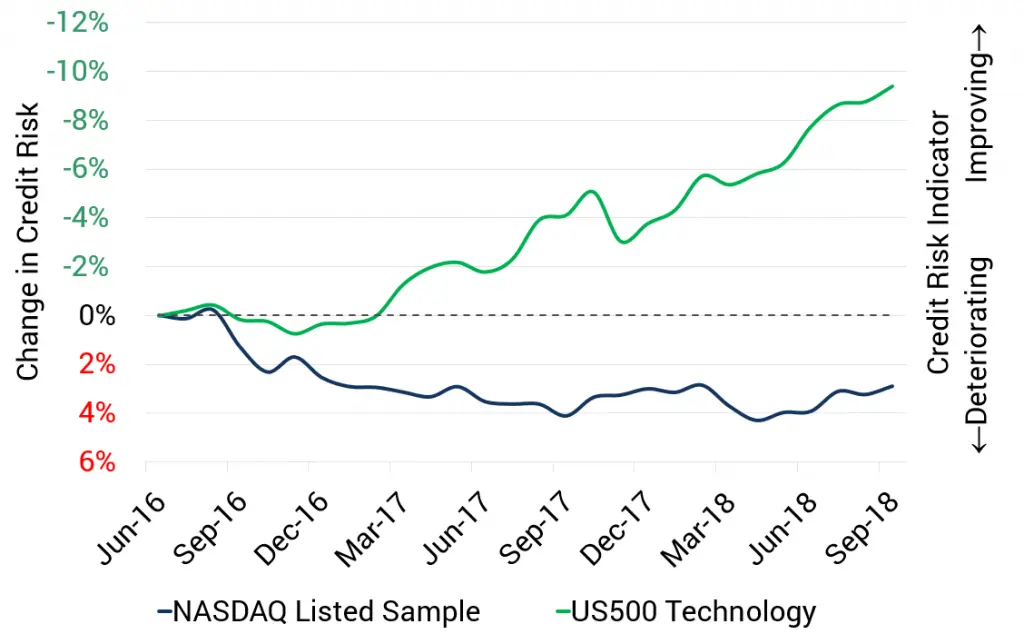

The below chart shows cumulative credit trends for the US technology sector. A rising line implies improving credit quality, a falling line implies a deterioration in credit. The blue line represents a sample of around 1000 NASDAQ listed companies, and the green line represents the 47 Technology companies in the S&P500, including the FAANGs. Interestingly, excluding the FAANGs has very little impact on this trend line. Credit risk for the S&P technology companies has improved by about 10% since June 2016; for the NASDAQ sample, it has deteriorated by about 3% over the same period. This suggests that the smaller technology companies – many of them suppliers to the giants – are more vulnerable in the event of a sustained tech downturn.

If the tech headwinds continue, stock market pessimism may be justified, especially for the smaller suppliers. But for now, bank analysts view the tech giants as solid credits.

*Facebook, Apple, Amazon, Netflix and Google