Recent data shows global semiconductor sales growing at nearly 30% YoY. Covid and East-West tensions have disrupted production and trade flows in this area, and various industries have had to accept significant price hikes to ensure that supplies are maintained.

The chip shortage is permeating many aspects of daily life – for example, long lead times for new cars have driven used car prices to record levels; iPhone 13 production runs have been scaled back; and expectations for ever-faster and more realistic game graphics and TV displays will have to be scaled back.

The electronic chip shortage has pushed some auto companies to seek closer partnerships with semiconductor firms; good for the largest firms but squeezing supplies even further for smaller firms and other industries. With rebounding demand and ring-fenced supplies, high prices are likely to persist for the foreseeable future.

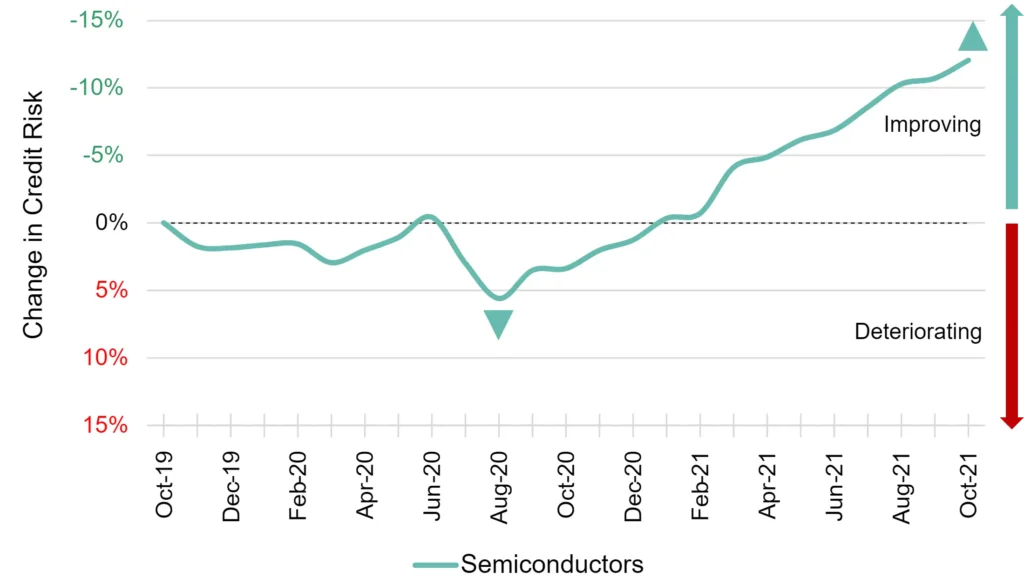

Figure 1 shows the credit trend for the 24 Semiconductor companies listed on the iShares Semiconductor ETF index [please continue below to access full report].

Please complete your details to continue reading this report: