Russia blames its latest foreign currency default on a technicality – their means and willingness to pay blocked by Western sanctions. But a growing list of countries have already seen Sovereign ratings slide in the past two years due to COVID costs; some now face a real risk of outright default as the war in Ukraine drives food, fertilizer and energy prices higher. The stronger Dollar is good for commodity producer margins, but rising interest rates hit global demand and weaker regional currencies increase debt servicing burdens.

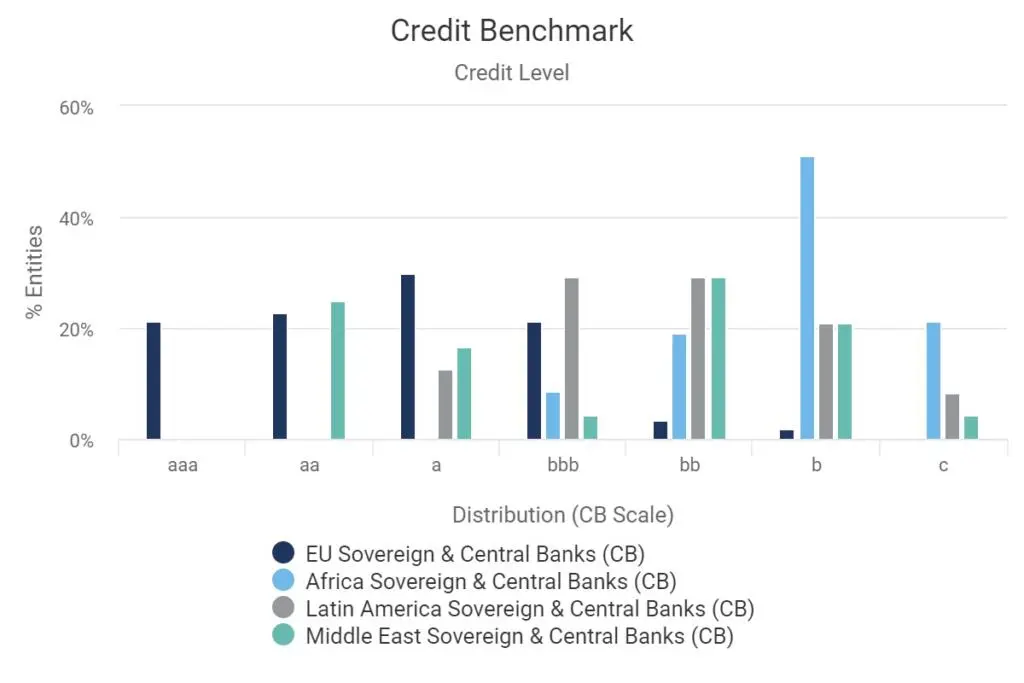

Figure 1 shows regional sovereign & central bank credit trends and credit distribution.

Detailed consensus credit data is available on Bloomberg or via the CB Web App, covering many otherwise unrated companies. Contact Credit Benchmark to start a trial or to request a coverage check.

Figure 1: Regional Credit Trends and Credit Distribution

EU Sovereign risk has steadily improved over the last two years, but is now plateauing. The Middle East has been stable, and higher energy price benefits may balance the hit from rising food costs – but the gap between winners and losers will grow. Africa continues to deteriorate, and Latin America – always volatile – is heading down.

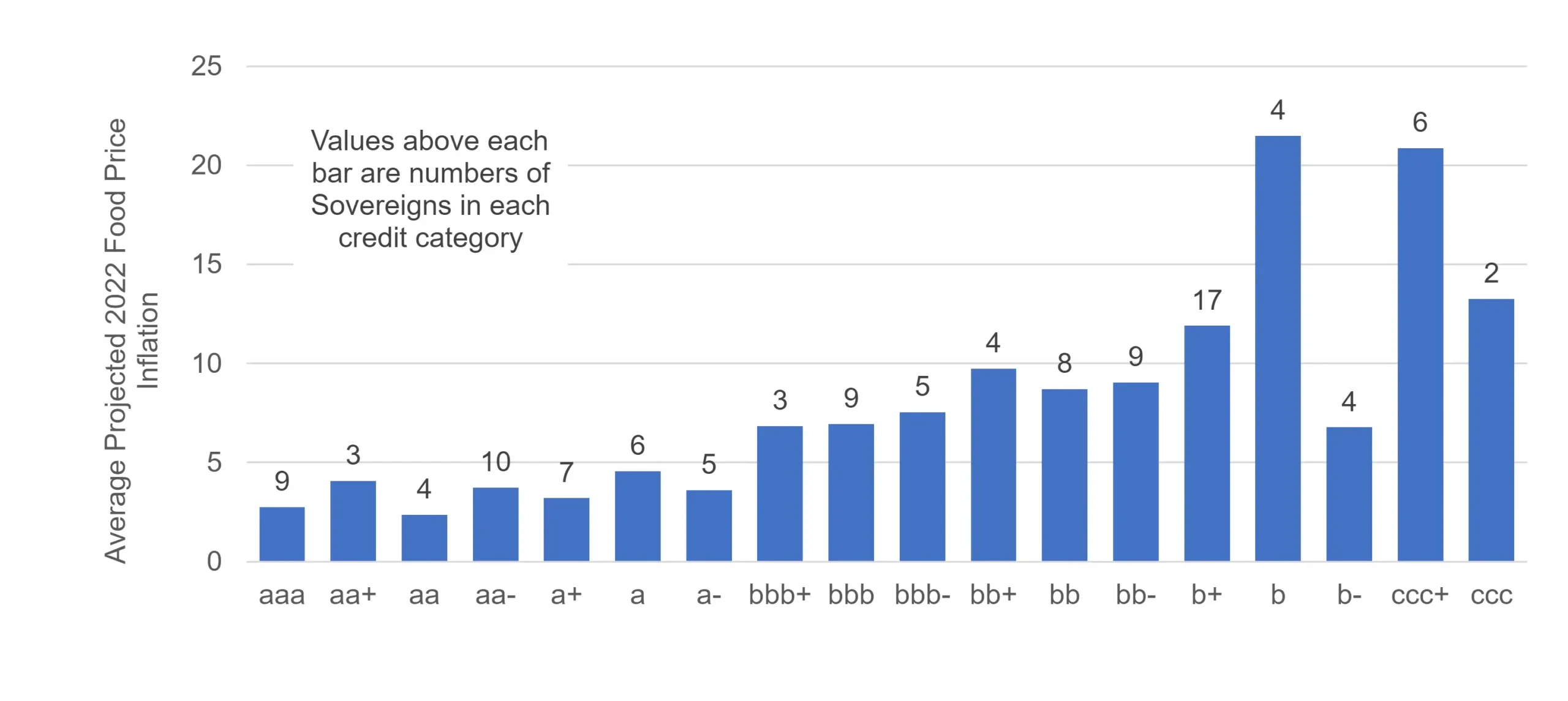

Figure 2 shows projected 2022 food price inflation by credit category.

Figure 2: Projected Food Price Inflation and Sovereign Credit

High food price inflation has a disproportionately negative effect on most of the countries that already have low credit quality.

Countries with a combination of poor consensus rating (b or c) and high sensitivity to food price inflation (projected >20% in 2022), and hence at higher risk of being pushed into default / bailout territory include Angola, Egypt, Ethiopia, Ghana, Turkey, Malawi, Nigeria and Paraguay.

Countries in the bb category with similarly high food price inflation include Georgia and Kazakhstan (Credit Benchmark Credit Consensus Rating = bb+, although agency ratings still show it as investment grade). Colombia, currently bbb- (although agencies rate it as high yield), is also facing excessive food price inflation.

Six of these countries are in Africa, two in Latin America, two in the Black Sea region and one in central Asia. Turkey and Kazakhstan have had serious food and energy riots already; there has been similar unrest in Peru, Tunisia, Uganda and Sri Lanka.

Some of the countries on this list have external revenue sources that may cushion the blow; Nigeria has oil and Kazakhstan has oil and uranium. But for most the impact of food price inflation is direct and likely to become more severe in the coming 12 months.

Credit Benchmark consensus data is updated twice monthly, so it can capture the downward drift that is often a precursor to Sovereign default or bailout. Data is available in flat files, APIs and a web application with portfolio alerting functionality.

Enjoyed this report? If you’d like to see more consensus-based credit ratings, mid-point probabilities of default and detailed analytics on 60,000+ public and private global entities, please complete your details to start a trial or to request a coverage check: