The risk of a US Government shutdown is focusing attention on Sovereign credit risk. While various sleights of hand (such as daily changes to bond maturities) are possible, there remains a small but significant risk to US Treasury bond payments in October. A missed payment – even if it is only deferred – would be a major market event. S&P famously downgraded the US to AA+ in 2011 under similar circumstances, and it has never moved it back. Fitch currently have a negative outlook on their AAA rating for the US.

But the broader issue is how Governments around the world handle the cost of COVID [please continue below to access full report].

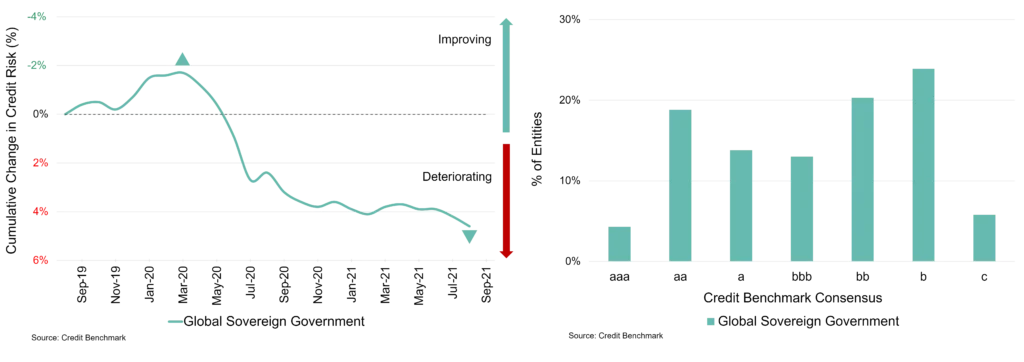

Figure 1: Two-Year Trends in Sovereign Credit Risk

Please complete your details to continue reading this report: