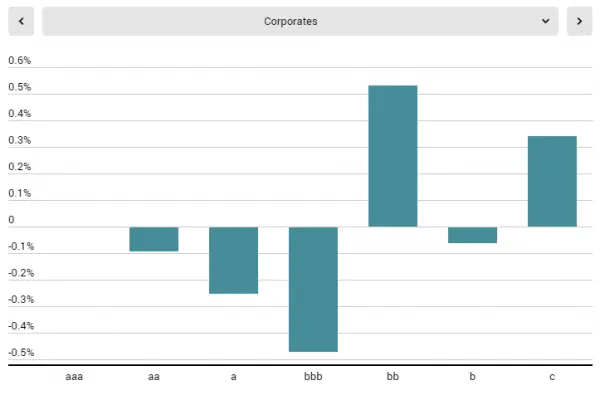

Monthly credit movement from April’s consensus data.

As governments move to ease the lockdowns put in place to slow the spread of the coronavirus, the financial blow to businesses is coming into sharper focus. The latest Credit Benchmark data for April 2020 reveals sharp deteriorations across a swath of industries.

Oil and gas companies were the worst hit, with 92% of credit movement in April to the downside. The sector faces severe challenges.

In this series of monthly articles from Risk.net, David Carruthers, head of research at Credit Benchmark, looks at the industries and sectors most affected by the coronavirus based on credit movement from April’s consensus data. Corporates have been hit hard, with deterioration accounting for 82% of total credit movement last month. Oil and gas firms, as well as basic materials, consumer services, and telecommunications, performed poorly.

The analysis is broken down across three charts:

- The opinion indicator marks the most affected industries and sectors.

- The distribution changes track the rate of credit category migration for industries and sectors.

- The rate of entities migrating from investment grade to high yield.

Read the full article using the below link:

View original article (external link)