Insights

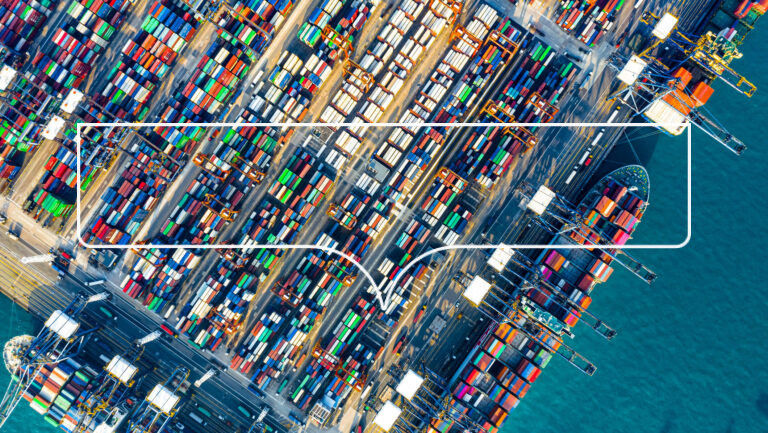

Credit Spotlight on Tariffs: The Wider Impact

Tariffs are reshaping trade and credit risk. Credit Benchmark data highlights early signs of strain and resilience.

FILTER:

ARCHIVES:

SEARCH:

Cyprus Peace Talks Face Growing Obstacles But Success Would Improve Credit Standing

Cyprus is steadily recovering from its recent financial difficulties. Despite being downgraded to junk during the 2012/13 financial crisis, it has managed to exit the EU-led rescue package, and re-started bond issuance in 2014. Earlier this month, the Bank of Cyprus (the largest commercial bank) announced that it had fully

US Corporate Credit Deteriorated Last Year

The U.S. Federal Reserve started the long process of normalizing interest rates in late 2015. But with the US economy growing by a lacklustre 1.6% in 2016, and inflation at a benign 1.3%, Yellen chose to wait a full year before the recent hike in December 2016. With President-elect Trump

Despite A Year Of Negative Headlines, Banks Are Measured On Russia

Over the course of 2016, Vladimir Putin’s Russia has rarely been out of the headlines, and it’s seldom been positive. In late December, the Russian ambassador to Turkey was killed in an attack allegedly related to Russian involvement in Syria; and this is not the first time that Putin’s continued

Sovereigns Show Higher Risk Premiums Than Corporates, But The Gap Is Closing

2017 is likely to be a year of fiscal expansion across a number of developed economies. Low interest rates are losing effectiveness in a growing number of economies and the Fed may resume its rate rises this week. But the ECB package announced last week shows that some Central Banks

Banks Take Italian Referendum Risk In Their Stride

Italian Sovereign bond yields have been trending higher ahead of the referendum on Sunday which may decide the fate of Renzi, the reforming Prime Minister. They are currently showing that ‘No’ is ahead by 5-7 points, but this is a year when political polls have been proven wrong more than

FTSE100 Credit Risk Steadily Increased In Q2 And Q3

The FTSE100 has gained around 10% since the Brexit vote. This is driven in part by Sterling weakness, which has brought an immediate currency translation benefit to the numerous overseas earners in the index. Recent company results have highlighted volume winners such as Burberry, who have seen overseas buyers taking