Insights

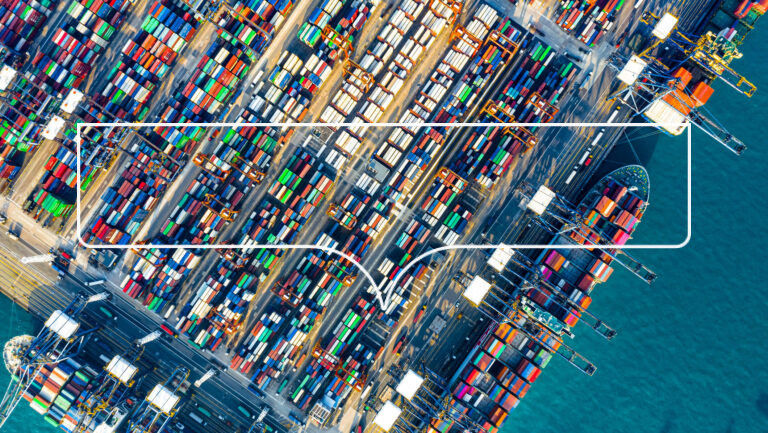

Credit Spotlight on Tariffs: The Wider Impact

Tariffs are reshaping trade and credit risk. Credit Benchmark data highlights early signs of strain and resilience.

FILTER:

ARCHIVES:

SEARCH:

Credit Spotlight on US & UK Media: High Yield & Investment Grade Indices

High-yield rated US and UK media companies are deteriorating rapidly, creating a growing chasm between these and investment grade firms.

Credit Spotlight on German Corporates

German Corporates are facing accelerated credit deterioration amid economic struggles, with Consumer Goods, Healthcare, and Basic Materials hit the hardest.

Credit Spotlight on African Sovereign Ratings

Growing commodity exports may see African sovereign default risk improve by 10%+ in next year, according to Credit Benchmark’s credit risk forecast.

Credit Spotlight on UK Water Industry

UK water firms are under scrutiny after the recent default of Thames Water owner Kemble; Credit Benchmark’s consensus risk data has been flagging problems in the water sector for some time. Default risk forecasts estimate that sector risk is set to rise by at least 10% in the next year, with potential to rise by as much as 20%.

Credit Spotlight on Global Credit Cycles

Credit Benchmark’s consensus dataset reflects historical economic upheaval through clear global credit cycles. Sector-level “leaders and laggards” within a cycle can be used in portfolio management to model transition matrix changes and provide valuable insights into the future credit profiles of sector exposures.

Credit Spotlight on Significant Risk Transfer

A new SRT case study explores how projected default rates, derived from credit consensus data, can be used to manage portfolio risk and optimise trade structures.