Earlier this year, we unveiled the findings of our research into credit risk trends in the Oil & Gas sector. The report covered credit risk estimates for more than 384 entities in the sector, including many companies which are unrated by the “Big Three” credit ratings agencies. At the time the report was published, every sector of the oil and gas industry showed a credit quality decline over 2016, with some continuing to decline into the first of 2017.

It would seem that view has changed.

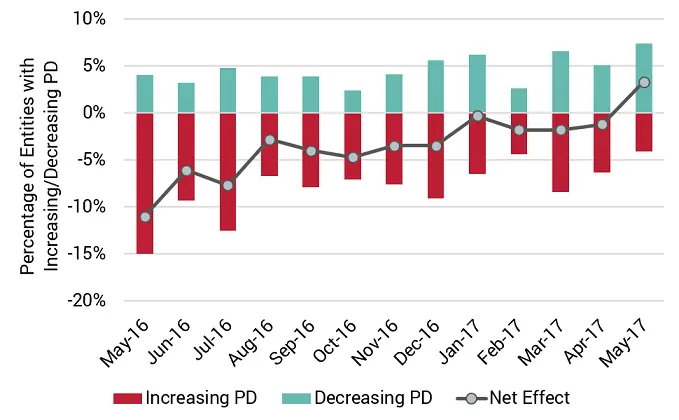

The latest Credit Benchmark Consensus (CBC) data across the Oil and Gas sector (pictured below), indicates that the percentage of entities with decreasing Probability of Default (PD) now outweighs those with increasing PD – a significant shift from previous quarters this year.

| Feb-Mar | Mar-Apr | Apr-May | |

|---|---|---|---|

| PD increases | 8.4% | 6.3% | 4.1% |

| PD decreases | 6.6% | 5.1% | 7.4% |

The Credit Benchmark Consensus indicates the credit risk assessments of the world’s leading banks. Perhaps this sentiment shift in Oil and Gas is a sign of new-found optimism for the sector. Our analysts will continue to observe for trends in the coming months.

Credit Benchmark brings together the credit risk assessments of the world’s leading banks to deliver greater visibility into the credit quality of individual entities. Using an innovative approach, Credit Benchmark aggregates, anonymizes and publishes monthly consensus credit indicators on sovereigns, financial institutions, corporates and small and medium enterprises (SMEs).

Call-to-Action – Contact us to learn more: wwwdev.creditbenchmark.com/contact