Credit Benchmark have released the November Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Oil & Gas based on the consensus views of over 20,000 credit analysts at 40+ of the world’s leading financial institutions.

Drawn from more than 950,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for Oil & Gas. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

US Oil & Gas firms have put a recent negative blip behind them with another month of positive credit quality, while UK and EU firms also continue to enjoy net credit improvement.

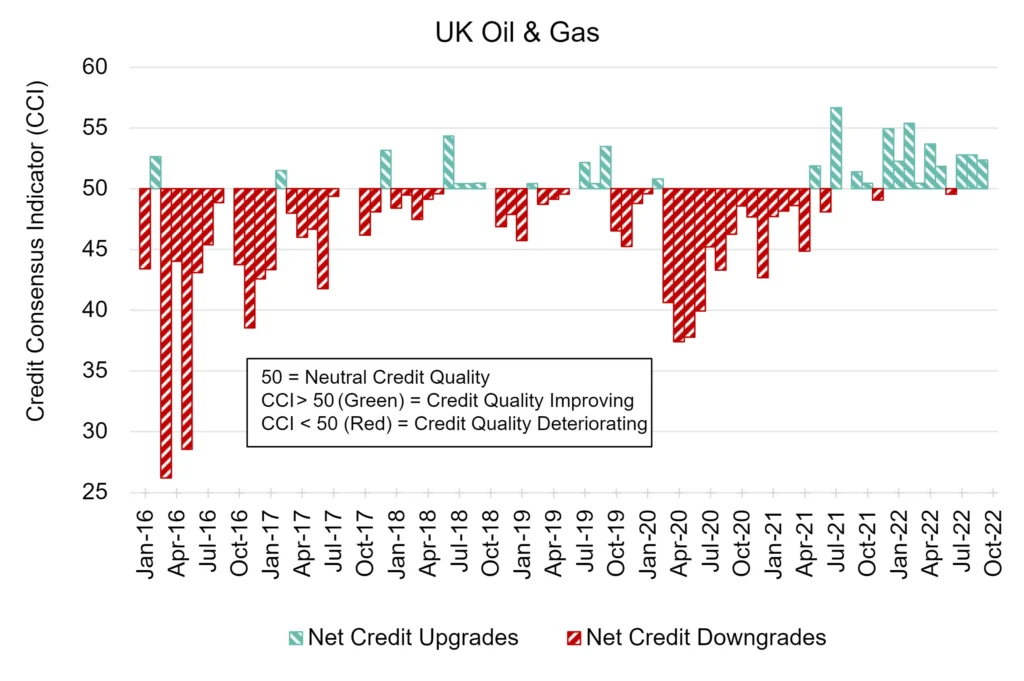

UK Oil & Gas: Improvement Persists

The improving trend for UK Oil & Gas firms continues, with a third consecutive month of credit quality in the green.

The UK Oil & Gas CCI score is 52.3 this month, a slight decrease from last month’s CCI of 52.8.

The UK has opened up a new licensing round to allow oil and gas companies to explore for fossil fuels in the North Sea despite threats of a legal battle from climate campaigners.

.

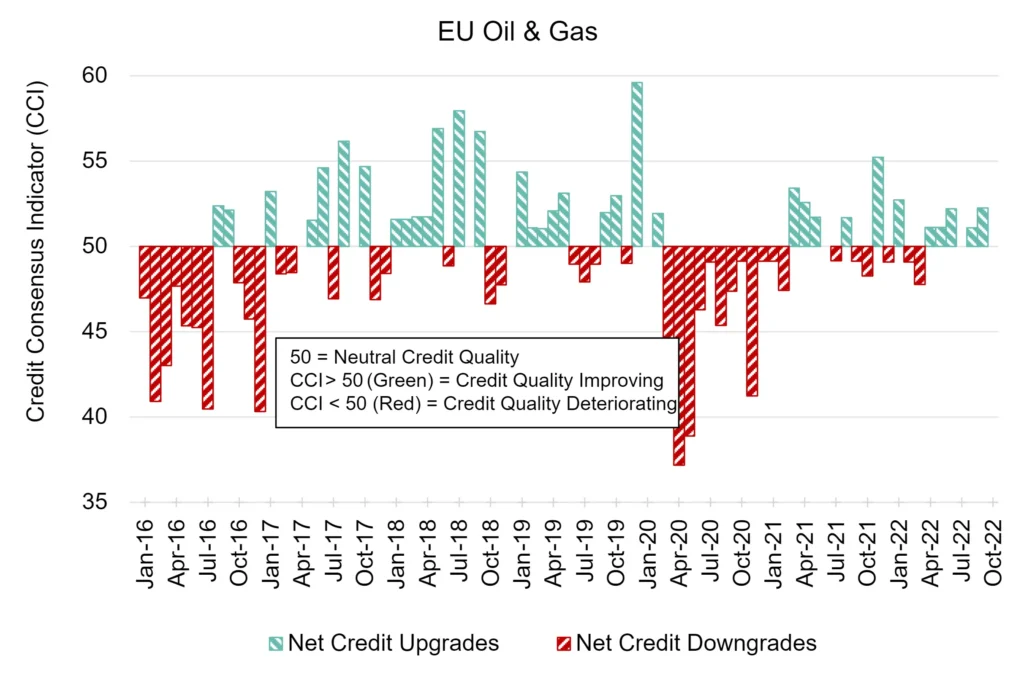

EU Oil & Gas: Increased Improvement

After some instability in their collective credit quality at the beginning of this year, the consensus outlook on EU Oil & Gas firms has kept itself out of net deterioration territory for a sixth month running.

The EU Oil & Gas CCI score is 52.2 this month, an improvement from last month’s CCI of 51.1.

Europe is set to increase its reliance on oil imports from the United States after the EU embargo on Russian seaborne crude imports enters into force in early December

.

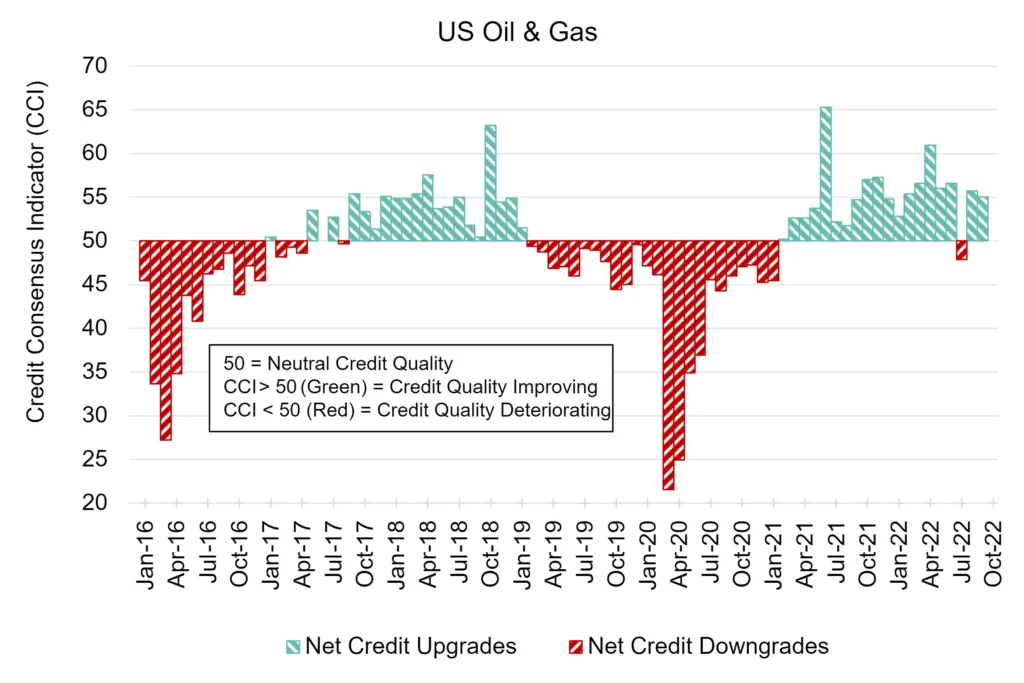

US Oil & Gas: Maintained Improvement

After ending a streak of 17 consecutive months of positive credit quality in July-22, US Oil & Gas firms have maintained positive credit quality for the second month running.

This month, the US Oil & Gas CCI score is 55.1, a slight decrease from last month’s CCI of 55.7.

US president Joe Biden claimed oil companies were “profiteering” from Russia’s invasion of Ukraine as he threatened them with legislation to impose a windfall tax unless they increase output.

.

To download the full CCI tear sheets for UK, EU, and US Oil & Gas, please enter your details below: