To download the November 2020 Retail Aggregate PDF, click here.

The outlook for the US retail sector is now less bleak than in earlier months. After disappointing sales data in September, data released in October was more upbeat, even amid ongoing concerns about the economy. The economic situation is similar in the UK, with sales data released in September and October showing gains despite ongoing weaknesses in the economy, but credit quality for the UK retail sector continues to deteriorate. COVID-19 cases are flaring up in both countries.

Is This a Turning Point or a Temporary Reprieve?

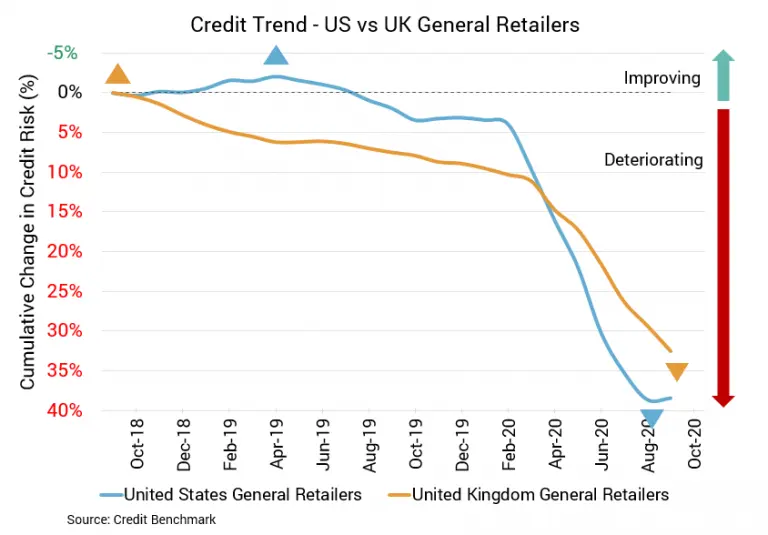

- Credit quality for the US retail sector has finally stopped declining, but credit quality is still weak after previous declines

- UK retail sector credit quality is still deteriorating and default risk remains far above that of the US

US General Retail Firms

After a long and persistent downward trend, the deterioration in credit quality for the US retail sector has halted. Credit quality for US general retail firms is unchanged from the prior update, yet it’s still down about 26% from six months prior and about 36% from the same point last year. Likewise, default risk has stabilized, but average probability of default for the sector remains significantly higher than it was six months prior or at the same point last year. Average probability of default is now about 57 basis points, compared to about 45 basis points six months prior and about 42 basis points at the same point last year. The decline in credit quality is evident in this aggregate’s overall Credit Benchmark Consensus (CBC) rating of bb. Approximately 77% of firms have a CBC rating of bbb or lower.

UK General Retail Firms

Unlike the US retail sector, UK retail sector credit quality continues to decline. Credit quality for UK general retail firms is down about 2% from the prior update, about 19% from six months prior, and about 23% from the same point last year. The ongoing decline in credit quality is apparent in the sector’s average probability of default, which is currently about 84 basis points. That’s significantly higher than what we’re seeing in the US. It’s also up from 82 basis points in the prior month, about 71 basis points six months prior, and about 69 basis points at the same point last year. An overwhelming majority of firms in this aggregate – about 92% – have a CBC rating of bbb or lower, and its overall CBC rating is bb+.

About Credit Benchmark Monthly Retail Aggregate

This monthly index reflects the aggregate credit risk for US and UK General Retailers. It illustrates the average probability of default for companies in the sector to achieve a comprehensive view of how sector risk will be impacted by trends in the retail industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.

Credit Benchmark brings together internal credit risk views from 40+ of the world’s leading financial institutions. The contributions are anonymized, aggregated, and published in the form of entity-level consensus ratings and aggregate analytics to provide an independent, real-world perspective of risk. Consensus ratings are available for 50,000+ financials, corporate, funds, and sovereign entities globally across emerging and developed markets, and 75% of the entities covered are otherwise unrated.