Credit Benchmark have released the May Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 20,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

EU and US Industrial firms have cause for cheer this month, but the UK is the real stand out. After hovering near a neutral CCI of 50 in recent months, the score leapt well above this month to 54.2, the largest net positive position since CCI tracking began. Positive market news has given cause for optimism, particularly for UK manufacturers. The nation also remains a leader in vaccinations. The Bank of England left monetary policy loose and upgraded its growth forecast, and the economy is moving in the right direction, with some projecting faster growth for the UK than the US.

There are some lingering issues, notably supply chain problems. But overall, this was the best month for forward-looking consensus data in quite some time. Industrials may be on the mend.

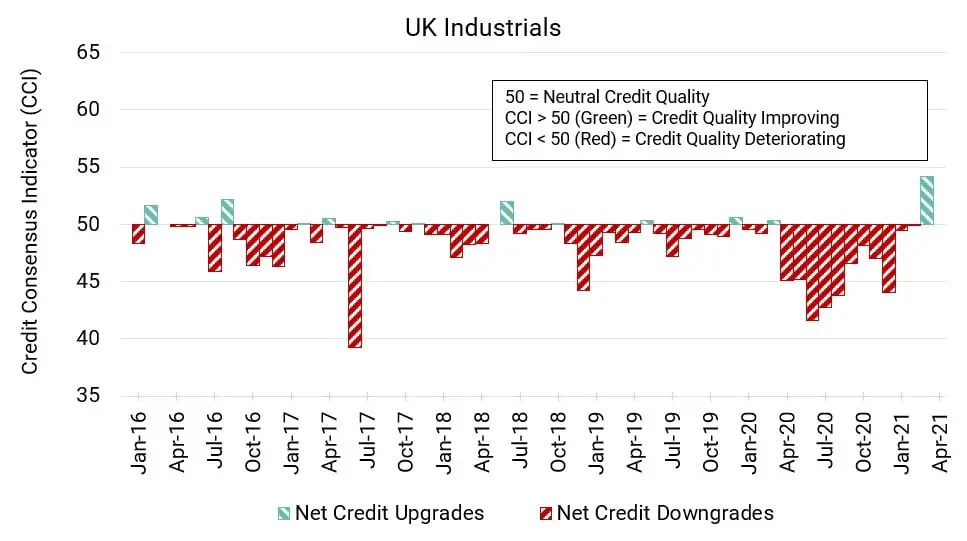

UK Industrials: Credit on the Up

UK Industrial companies took a big leap forward this month after a year of deterioration.

This month’s CCI is 54.2, well above last month’s 49.9 and the best score yet.

In addition to supply chain problems, there are manufacturing profitability concerns and issues around Brexit. Still, with the economy set for a strong rebound, this will keep pressure on Industrials to move in the right direction.

.

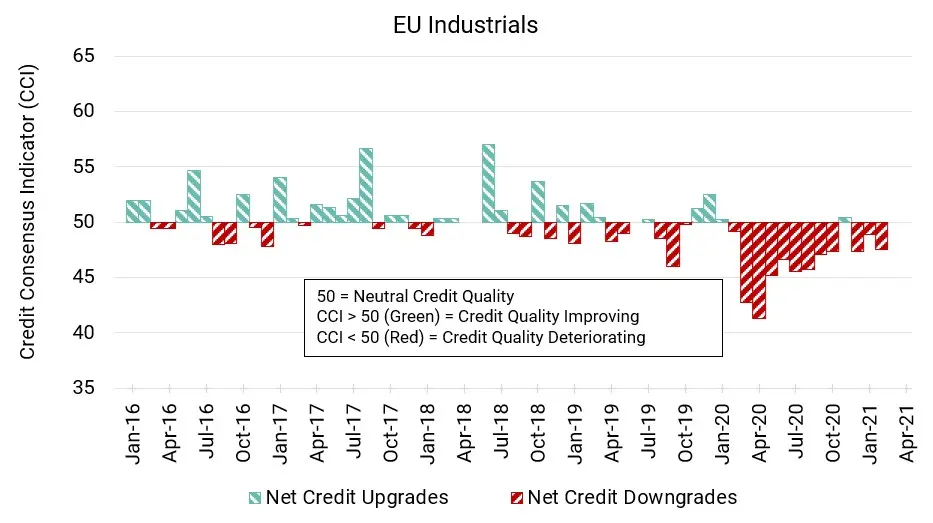

EU Industrials: Slow, but Steady

EU Industrial companies are close to crossing a key threshold.

This month’s CCI is a neutral 50, up from last month’s negative score of 47.6 and moving in a positive direction.

With its vaccination program on track and monetary policy remaining loose, the EU has a strong foundation. Air travel is set for a boost. The biggest negative for the region may be supply chain disruption.

.

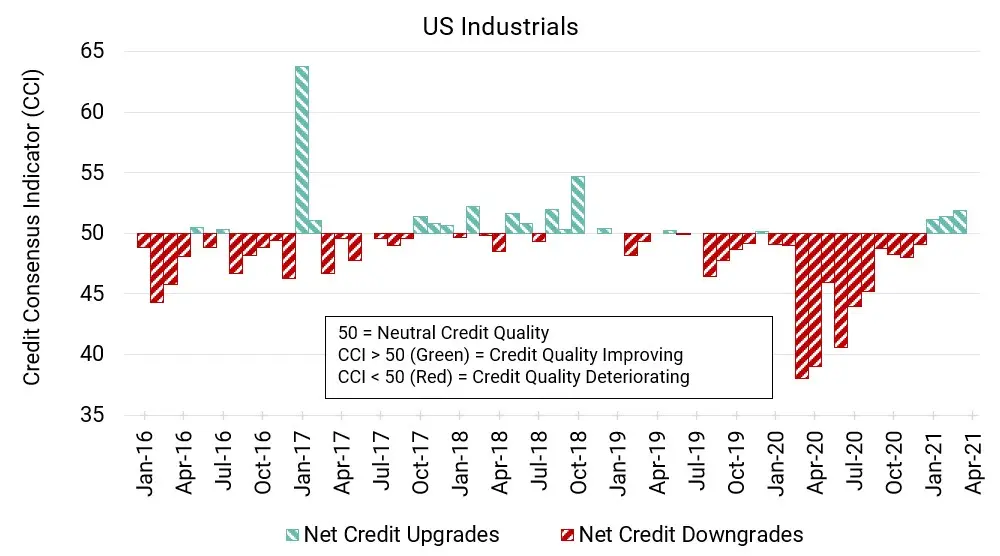

US Industrials: Continued Improvement

US Industrial companies registered a net positive score above 50 for the third consecutive month.

This month’s CCI is 51.9, up slightly from last month’s 51.4.

The US economy was in a strong position prior to the latest data release and remains so even with some blips like a weak jobs report. The Fed, which is keeping its accommodative monetary policy, thinks inflation may be transitory. Air travel is picking up. Even with supply chain problems as obstacles, the US is on a solid path.

.

To download the full CCI tear sheets for UK, EU, and US Industrials, please enter your details below: