To download the May 2021 Auto Aggregate PDF, click here.

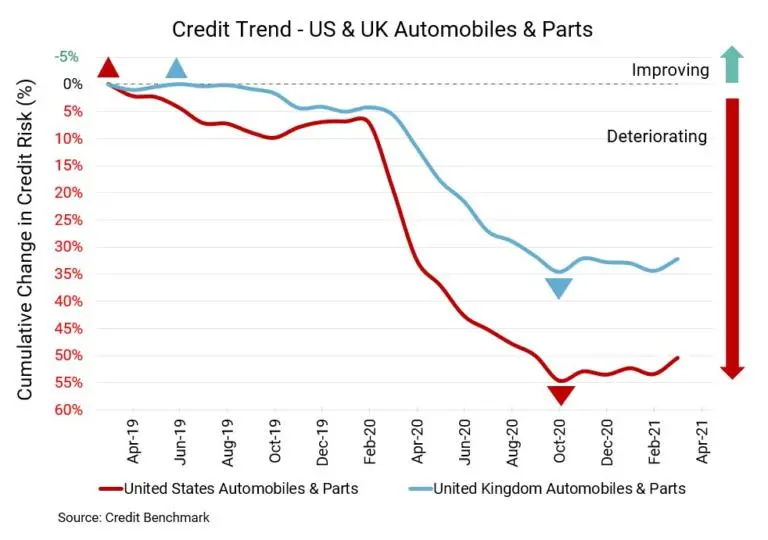

The brakes have been pumped on 2020’s credit deterioration in the US and UK auto sectors. Consensus credit data is showing improvement after a long period of stress.

Signs of momentum are numerous. US auto sales were projected to double in April; they are also now increasing in the UK. Consumer spending is in a solid position and will continue to strengthen as both economies improve.

Amidst various pandemic pressures, one of the biggest issues facing these auto sectors is supply chain problems, with frequent accounts of auto sector disruption. There are some indications the problem is getting worse and causing longer-term changes to manufacturing processes.

With estimates that the situation may not improve until at least Q4 2021, supply chain disruptions will continue to entangle the auto sector for the foreseeable future.

US Auto and Auto Parts Industry

After months of declines in credit quality, the US auto sector saw improvement of 2% in the most recent data. There’s also been little change over the last six months. Still, credit quality is down 26% year-over-year. Default risk is currently 47 bps; it was 48 bps last month, 47 bps six months ago, and 38 bps at the same point last year. Now this sector’s overall rating is bbb- and 75% of firms have a CCR rating of bbb or lower. Overall US Corporate default risk is 66 bps, with a CCR of bb+ and 82% firms at bbb or lower.

UK Auto and Auto Parts Industry

While still in far worse shape than its US counterpart, the UK auto sector also saw credit quality improve by 2% in the latest update and has seen little change over the last six months. Of course, credit quality is down by 26% year-over-year. Default risk is currently 88 bps; it was 89 bps last month, 88 bps six months ago, and 70 bps at the same point last year. Now this sector’s overall rating is bb and 90% of firms have a CCR rating of bbb or lower. Overall UK Corporate default risk is 80 bps, with a CCR of bb and 91% firms at bbb or lower.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Consensus Rating (CCR) is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.