To download the May 2020 Oil & Gas Aggregate PDF, click here.

.

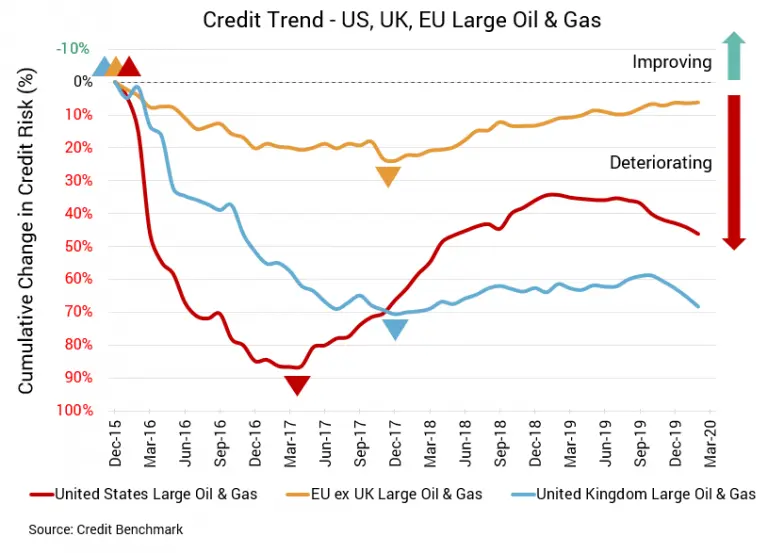

The energy sector remains in a precarious position. Even with a recent upward trend in prices, helped by an OPEC agreement to cut production, the underlying economy remains weak and many are traveling far less than they used to before the pandemic emerged. Supply will remain higher than demand until this changes.

Default Risk for US Firms Surges by Double Digits from Last Month

- Credit quality for US-based firms worsens by 10% in last month, and by a larger 18.8% year-over-year.

- Credit position for US-based firms remains much worse than UK-based firms, whose credit quality has also declined.

- Credit Benchmark Consensus (CBC) rating for US-based firms has changed to bb+.

US Oil & Gas

Credit quality for large US oil & gas firms is in a tailspin, down not just compared to its UK and EU counterparts, but also experiencing one of the most significant declines of all the sectors tracked by Credit Benchmark. Credit quality for the sector has declined by 10% from the prior month and 18.8% over the last year. The average probability of default for the sector is now 49.9 basis points, compared to 45.4 basis points in the prior month and 42 basis points at the same points last year. The aggregate’s CBC rating has been at bbb- across the last year but after edging close to a downgrade, and has now dropped into bb+.

UK Oil & Gas

Credit quality for large oil & gas firms in the UK is also weakening. This aggregate saw a drop of 1.9% month-over-month and 5.6% year-over-year, with an abrupt change in quality in the last six months. The average probability of default for the sector is now 36.1 basis points, compared to 35.5 basis points in the prior month and 34.2 basis points at the same point last year. The CBC rating has stayed at bbb- for the last 12 months.

EU Oil & Gas

Changes in credit quality for large oil & gas firms in the EU remain minor. There was a decline in credit quality of 1.8% month-over-month, yet the year-over-year change was an improvement of 1.6%. Aggregate probability of default is now 24.2 basis points — up from 23.8 basis points in the prior month, but down 24.6 basis points at the same point last year. The CBC rating for the sector is bbb-, unchanged over the last year.

.

About The Credit Benchmark Monthly Oil & Gas Aggregate

This monthly index reflects the aggregate credit risk for large US, UK, and EU firms in the oil & gas sector. It provides the average probability of default for oil & gas firms over time to illustrate the impact of industry trends on credit risk. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.