The Economist reports that container unit costs have risen 4 to 6 times in the past 18 months while delivery times have nearly doubled. Local Covid outbreaks have resulted in temporary port closures around the globe, while changing consumption patterns have disrupted trade flows. These challenges have been compounded by deliberate capacity reductions at the start of the pandemic.

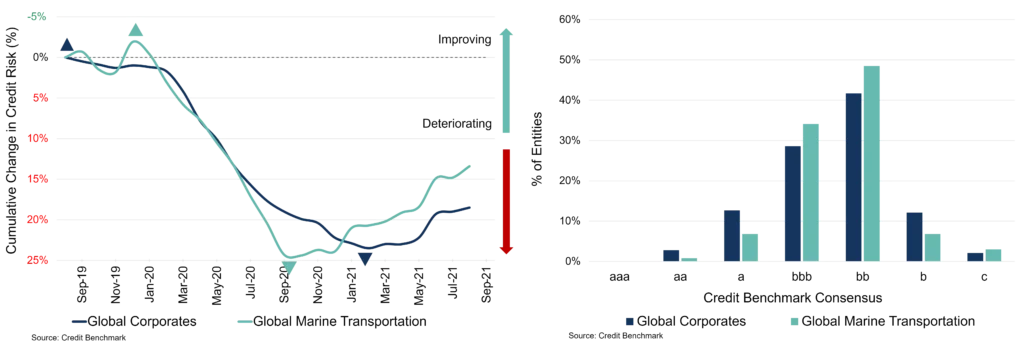

Figure 1 shows the trend and credit distribution for the Global Marine Transportation aggregate (131 firms) over the past two years compared to Global Corporates.

Figure 1: Credit trend and distribution for Global Marine Transportation vs Global Corporates

The steady decline from January 2020 is a noticeably early reaction to the Covid outbreak, pushing credit risk up by 25%. Recovery began in September 2020 – also earlier than many of the other industry aggregates. This suggests that the global Marine Transportation aggregate may be a leading indicator for overall credit risk [please continue below to access full report].